December 19, 2024

Every Little Thing You Require To Learn About Occupants Insurance Policy

Whatever You Require To Find Out About Tenants Insurance A mobile home occupants insurance policy also offers obligation insurance. You can be taken legal action against if you mistakenly cause injuries or kill a person. Without renters insurance policy, you could be liable for damages that may spoil you monetarily. All renters-- regardless of the type of location you stay in-- must think about purchasing renters insurance coverage. While there are many reasons tenants choose to rent out without insurance, one of the most usual is that they are ignorant concerning just what occupants insurance coverage is and exactly how it helps them. As a property owner, assisting to notify potential lessees concerning what all tenants insurance covers will certainly go a lengthy way in searching for or producing a renter happy to acquire renters insurance policy.6 Best Renters Insurance Companies in Oregon of 2024 - MarketWatch

6 Best Renters Insurance Companies in Oregon of 2024.

Posted: Mon, 29 Jan 2024 08:00:00 GMT [source]

Property Owners: Right Here's Why Your Tenants Ought To Get Renters Insurance

You need to however see to it that valuables such as expensive bikes and jewelry are consisted of within the maximum payment restrictions. You can examine these in our terms or by calling our client service. If home insurance policy covers irreversible components of your home in protected events. Long-term fixtures include flooring surfaces, wallpaper, cooking area closets and long-term washroom components, for instance. It is additionally possible to claim settlement for moving prices and costs from storage of movable residential or commercial property throughout restoration. If home insurance policy covers movable building that breaks instantly and unexpectedly in any situation. Theft by a roomie is normally not covered by occupants' insurance policy, so select your roomies intelligently. While landlords need renters insurance coverage to help reduce their threats, tenants insurance also benefits the occupant by safeguarding their home and lessening their danger. It's a method to help guarantee respect of property by both parties, maintaining the service in tip top form. In the case of common accommodation, everyone living in the exact same apartment must take out a separate home insurance policy that consists of basic liability and legal costs insurance coverage. In method, the flooring area of the apartment or condo is split among the tenants, with each having a separate insurance plan.Boost The Occupant Screening Procedure

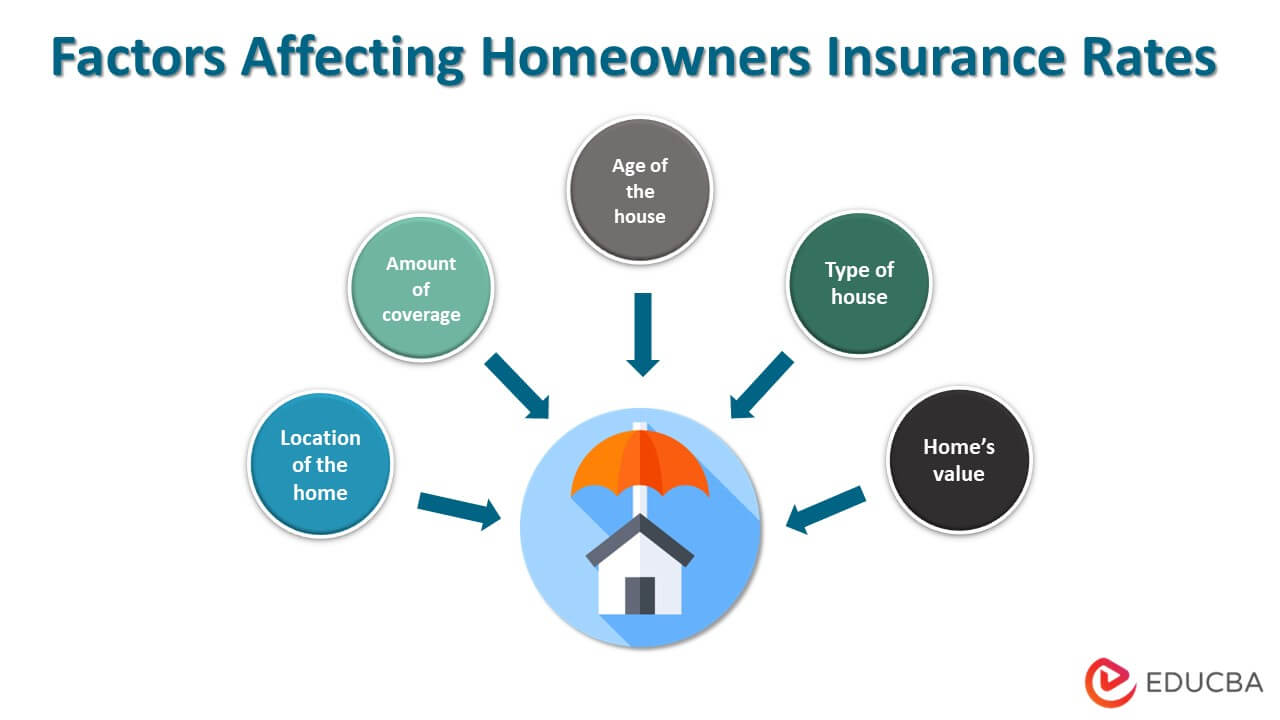

If you have a lot of pricey personal property-- or if you have lots of properties to shield from responsibility claims-- you will likely want even more coverage, which elevates the expense. Oftentimes, the insurance a property owner carries covers only the structure. Personal effects loss or damage, brought on by theft, criminal damage or fire are usually not covered by the landlord's plan. Without tenants insurance, the lessee might need to bear the monetary burden of a loss to their personal property. While landlord insurance policy commonly won't cover tenants' personal belongings if they're taken, damaged, or damaged, needing each renter to buy occupants insurance can decrease a landlord's legal responsibility. As a proprietor, it is necessary to consider the effects of not requiring your tenants to have tenants insurance policy.- If you have a great deal of expensive personal property-- or if you have several assets to secure from liability cases-- you will likely want more coverage, which elevates the price.

- Keep analysis as we guide you via why and exactly how to need occupants insurance coverage as a property manager.

- Responsibility coverage is also consisted of in common occupant's insurance plan.

- Requiring lessees to get insured aids reduced a landlord's direct exposure to unanticipated prices, and probably makes it less complicated to screen for accountable occupants.

Social Links