August 8, 2024

Pour Over Wills Under The Legislation Estate Intending Lawful Facility

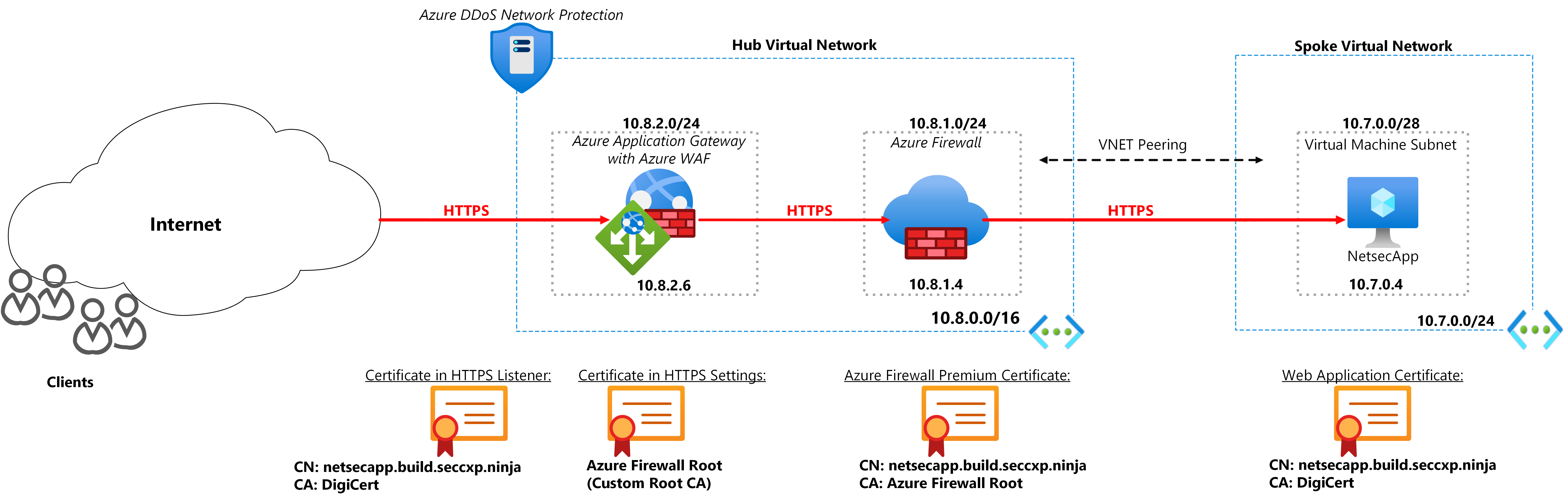

Revocable Depend On Vs Unalterable Trust Fund: What's The Difference? So, if you do not produce a pour-over will, those assets will certainly be treated as if the individual had died "intestate," that is, without a will, so assets will certainly pass to particular beneficiaries by legislation. These beneficiaries might vary from the trust fund beneficiaries, implying that your possessions can go to a person that you never ever intended. Suppose an older pair wishes to disperse an estate to their youngsters and grandchildren. Both standard types of trusts are a revocable trust, likewise referred to as a revocable living depend on or simply a living Protecting Assets from Creditors trust, and an irreversible depend on. They can remove recipients, assign brand-new ones, and customize terms on just how possessions within the depend on are handled. Provided the flexibility of revocable or living rely on comparison with the rigidness of an irreversible trust fund, it might appear that all trust funds need to be revocable.Revocable Count On (living Trust Fund)

At Count on & Will, we've made it simple to set up trust funds and wills with our online solutions. All you have to do is get started on our website and undergo our directed procedures with just a few clicks! We additionally have assistance specialists who can assist you along the way ought to you have any type of inquiries. Bigger estates will occasionally use irrevocable trusts to decrease the tax problem for beneficiaries, especially if they are likely to be based on inheritance tax. When grantors transfer possessions to an unalterable count on, the possessions come fully under the control of a trustee.Pour-over Will And Revocable Trust - Do I Need Both?

Discover why you might require this estate preparation device and just how it functions. An additional benefit of pour-over wills is that they provide more privacy than using a standard will. Assets that experience probate belong to a court's documents and can be easily located by any participant of the public.- Unlike a standard last will and testimony, a pour-over will certainly is not a stand-alone document, which's due to the fact that it requires something to pour into.

- In some states, the information on this web site may be considered a legal representative referral solution.

- Pour-over wills function by dictating that all a decedent's assets not already in their count on are instantly transferred to the count on when they pass away.

- You may fail to remember to move some possessions or you may just lack time and pass away before you obtain a possibility to relocate them all.

Jeffrey Epstein signed will just two days before suicide - New York Post

Jeffrey Epstein signed will just two days before suicide.

Posted: Mon, 19 Aug 2019 07:00:00 GMT [source]

Do wills expire in NY?

of drip is much faster. With the Mugen, the idea is that you pour in one fast go & #x 2014; here in 15 secs & #x 2014; then allow it drain. Making coffee by hand absolutely needs even more job, but it has countless advantages. Pour-overs offer you the possibility to absolutely dial in your brew by giving you a lot more control over the variables.

Social Links