August 30, 2024

Pour-over Wills Jacksonville Estate Planning Legal Representatives Legislation Workplace Of David M Goldman

Pour-over Wills Jacksonville Estate Planning Lawyers Regulation Workplace Of David M Goldman To prevent any complication after your passing, a pour-over will certainly should just include your individual possessions, and not any properties that are currently part of your living trust fund. Betty develops a living depend on and takes a mindful inventory of her financial properties. She diligently moves all her investments and bank accounts that she can think about into her living depend on. Betty names her partner, Joe, and her more youthful sister, Lisa, as the sole beneficiaries, with Joe as trustee/executor.Recent Changes to Pour Over Rules - Clark Wilson LLP

Recent Changes to Pour Over Rules.

Posted: Wed, 17 Jul 2019 07:00:00 GMT [source]

Does The Pour-over Will Need To Go Through Probate?

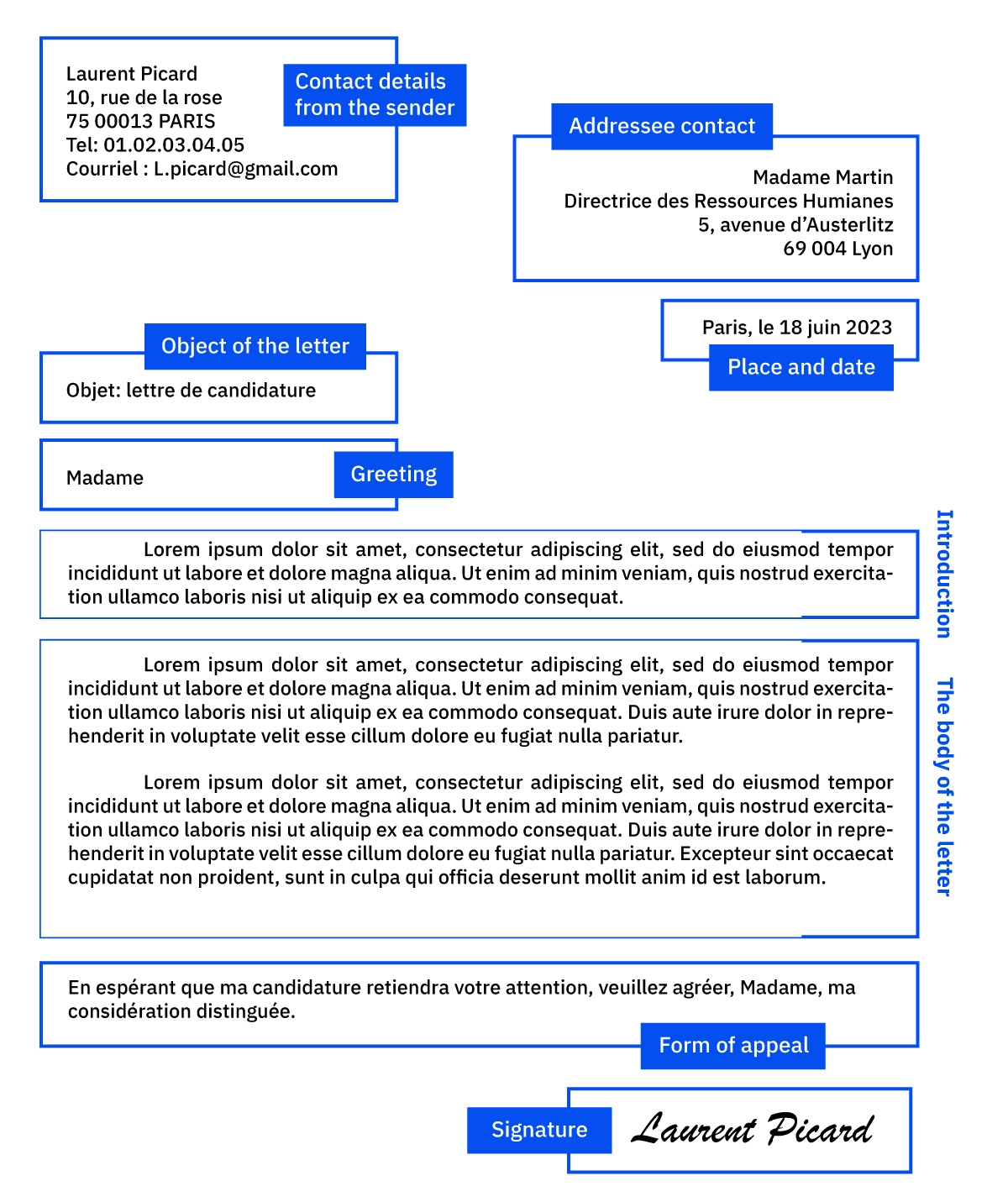

Collaborating with an Austin estate preparation lawyer is important to developing a valid and enforceable pour-over will. The The Golden State Probate Code has an one-of-a-kind provision that enables trusts to be created after a pour-over will holds. In many various other states, the depend on would have to be developed prior to the will, and the testator utilizes their will to indicate their wish that remaining possessions be moved right into the existing trust upon their fatality.Advantages And Drawbacks Of Pour-over Wills

A pour-over will is a type of will certainly with a provision to "put" any type of leftover or unallocated assets in a person's estate right into a living depend on when the person passes away. The idea is to reduce the probate procedure and ensure that properties are dispersed as the dead dreams. Allow's state you have two children and four grandchildren to whom you want to leave every one of your possessions after you are gone.- Please contact us if you desire to go over the contents of this website in more information.

- Because she just receives quarterly statements from that account and isn't actively dealing with it, the pension plan completely slipped her mind when setting up her living trust fund.

- You can be the trustee while you live and of audio mind and can call a backup trustee who will certainly take control of monitoring of trust fund assets when you end up being incapacitated or die.

- The distinction between a simple will certainly and a pour-over will is that a simple will certainly is indicated to handle your entire estate, such as by leaving it to your spouse or your kids.

- So, what is the link between a pour-over will and revocable trust fund?

Who lags the put over?

Social Links