August 7, 2024

Comprehending Exactly How Discretionary Depends On Work

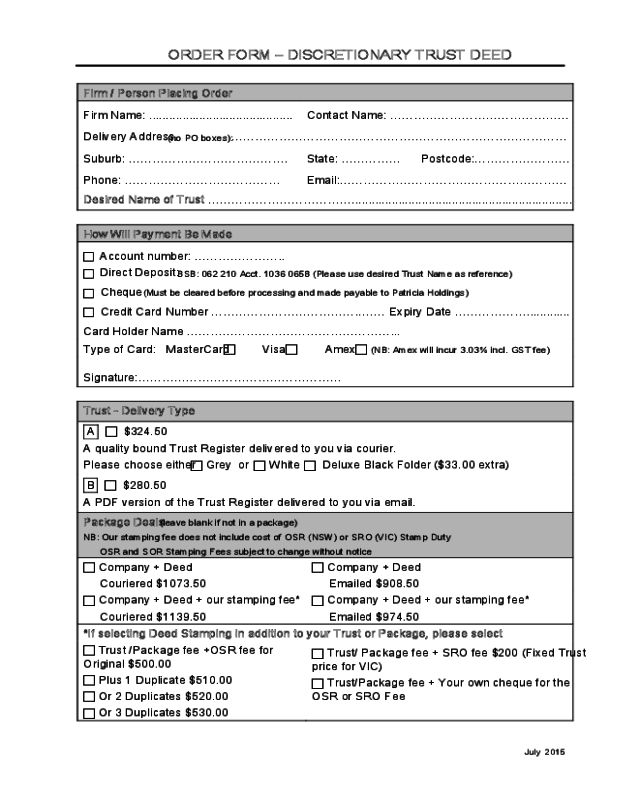

An Overview To Optional Trust Funds In straightforward terms, the depend on will certainly undergo tax obligation of 6% on the ₤ 263,000 which is ₤ 15,780. The trustee( s) might alter over the life of the trust fund and it is possible for brand-new and/or replacement trustee( s) to be selected and for the trustee( s) to be gotten rid of or retired. It was throughout these land disagreements that rely on legislation developed, beginning from the lawful term Client Segments "use land" to the trust fund system that we are now familiar with. Manisha signed up with the Society's Technical Guidance Team in July 2019 having formerly functioned as an Employment Lawyer in Warwickshire prior to transferring to Lincolnshire.Discretionary Depend On

- The benefit of entering their share of the estate in this depend on is that the trust fund funds will not be dealt with as belonging to the beneficiary as the trust fund possesses the possessions and will certainly as a result fall beyond the recipient's estate.

- For instance, the settlor may approve 70% of the trust fund's benefits to a partner and 30% of the count on's benefits to a kid.

- Having an optional trust fund makes it possible for an individual to be able to hold onto their possessions without the responsibility of being the lawful owner.

- What's unique concerning discretionary counts on is that the recipients are identified only as possible beneficiaries.

- A Discretionary Trust is an additional crucial method to protect your family members's future through estate preparation.

- They do not come to be actual beneficiaries up until the trustees make a decision to pass funds to them.

In Addition To Being An Extremely Flexible Kind Of Trust Fund, Optional Counts On Are Likewise Useful

Trust funds not just for super rich Business - News24

Trust funds not just for super rich Business.

Posted: Mon, 01 Jun 2015 07:00:00 GMT [source]

Extra Technical Support

Furthermore, this secures the money in the trust from financial institutions given that a financial institution or other complaintant can not affix a right to present or future cash that has actually not been distributed to the recipient. Within a discretionary depend on, you can offer specific advice to the assigned trustee relating to when distributions may be made. Due to the optional nature of the trust fund, there needs to be greater than one optional beneficiary. There can additionally be a course of people that are appointed as the discretionary beneficiaries i.e. youngsters or grandchildren. Possessions dispersed within two years of death will not suffer a tax cost off duty the count on. If an optional depend on is set up during the settlor's lifetime, the possessions within that trust fund might drop outside their very own estate if they pass away a minimum of 7 years after putting the properties into the trust fund. This will certainly have the effect of decreasing down the total value of their estate when it is evaluated for inheritance tax. The trustee( s) should act in the best rate of interests of the beneficiaries and must think about all beneficiaries when exercising their discretion. The trustee( s) will certainly have power over both the earnings and funding of the depend on and it is very important that they stay unbiased and take into consideration the wishes of the settlor. Likewise, a trustee can be guided to distribute funds upon abeneficiary's completion of particular landmarks-- such as college graduation orcompletion of rehabilitation. Therefore, if the funds in the trust exceed the nil price band, anniversary and exit costs will apply. Some recipients may have already reached the IHT limit and do not desire the inheritance they are to obtain to increase the size of their own estate. In this scenario, the trustees might just offer the money to the recipient. System depends on give the unit owners extra certainty regarding the advantages the recipients will receive. Device depends on can have substantial tax benefits for device owners as unit depends on are not considered separate tax obligation entities. Some may not be depended look after a big inheritance and there may be a worry that the cash will be spent at the same time. This sort of trust allows trustees to take care of the depend on fund to prevent this from occurring whilst offering the economic assistance as and when it is required. For customers that own their very own company an optional depend on can give a useful structure in which to pass on shares in a family company, therefore supplying protection for the advantage of future generations. It is in some cases described as a family count on Australia or New Zealand.How long can a discretionary trust fund last?

For how long can an optional count on last? The maximum quantity of time is 125 years, which is a statutory constraint under the Perpetuities and Accumulations Act 2009.

Social Links