Optional Depend On Wikipedia

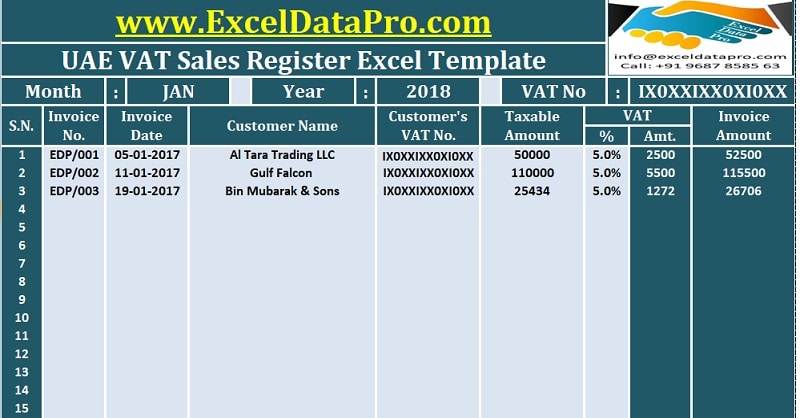

Discretionary Trust Fund Wikipedia In basic terms, the depend on will certainly be subject to tax obligation of 6% on the ₤ 263,000 which is ₤ 15,780. The trustee( s) may transform over the life of the trust and it is possible for new and/or replacement trustee( s) to be appointed and for the trustee( s) to be gotten rid of or retired. It was during these land disagreements that rely on legislation progressed, starting out from the legal term "use of land" to the trust fund system that we are now knowledgeable about. Manisha signed up with the Culture's Technical Recommendations Team in July 2019 having actually formerly worked as an Employment Lawyer in Warwickshire prior to relocating to Lincolnshire.Case Legislation: Dementia-induced Mild Cognitive Disability

Consequently, the trust's whole earnings or resources will certainly be dispersed to system holders before any kind of tax obligation is subtracted. Contrasted to optional trust funds where the shares are alloted at the discretion of the recipients, device trusts designate shares of the residential property in behalf of the recipients in the trust. Device counts on assign and determine a "device" in the trust fund residential property in advance, in accordance with the beneficiaries' percentage of "devices".Can I Add An Optional Trust To My Estate Strategy?

- Discretionary depend on possessions and income are likewise secured from circulation on separation.

- The beneficiaries can not oblige the trustee to utilize any of the depend on home for their benefit.

- Keep in mind that if any of the building had actually not been in trust for the full one decade (e.g. included funds), then relief is permitted the variety of quarters (40ths) that the home was not 'appropriate home'.

- A discretionary depend on is formed to allow the trustee( s) managing the trust to choose who can gain from the trust fund and just how much cash the beneficiaries will certainly receive.

- The Trustee has a good deal of power and should be selected extremely carefully.

Superannuation and testamentary trusts - AdviserVoice

Superannuation and testamentary trusts.

Posted: Thu, 13 Oct 2022 07:00:00 GMT [source]

Why would certainly you set up an optional trust fund?

A crucial element of an optional trust fund is that there must be several prospective recipients that can gain from it. For the most part, Depends on are established with specific terms that instruct the Trustee to distribute funds to recipients on a set routine. The terms additionally typically set just how much need to be distributed. Optional Trust funds are unique from other types of Depends on because there are no such terms. On each 10-year wedding anniversary, the count on is taxed on the worth of the depend on less the nil rate band readily available to the depend on, with the price on the extra being 6%( determined as 30 %of the life time price, presently 20% ). If the count on worth is much less than the zero price band, there will be on the house. Beneficiaries of an optional trust are not entitled to receive anything as of right. Rather the beneficiaries have the prospective to receive money and the right to ask the trustees to exercise their discretion in their favour. If an optional trust fund is established during the settlor's life time, the properties within that trust might drop outside their own estate if they pass away at least 7 years after placing the properties into the count on. This will certainly have the impact of minimizing down the overall worth of their estate when it is evaluated for estate tax. A life time optional trust or life interest depend on made to hold cash or investments will