August 10, 2024

The Legal Requirements To Begin A Small Business In The Uk Described

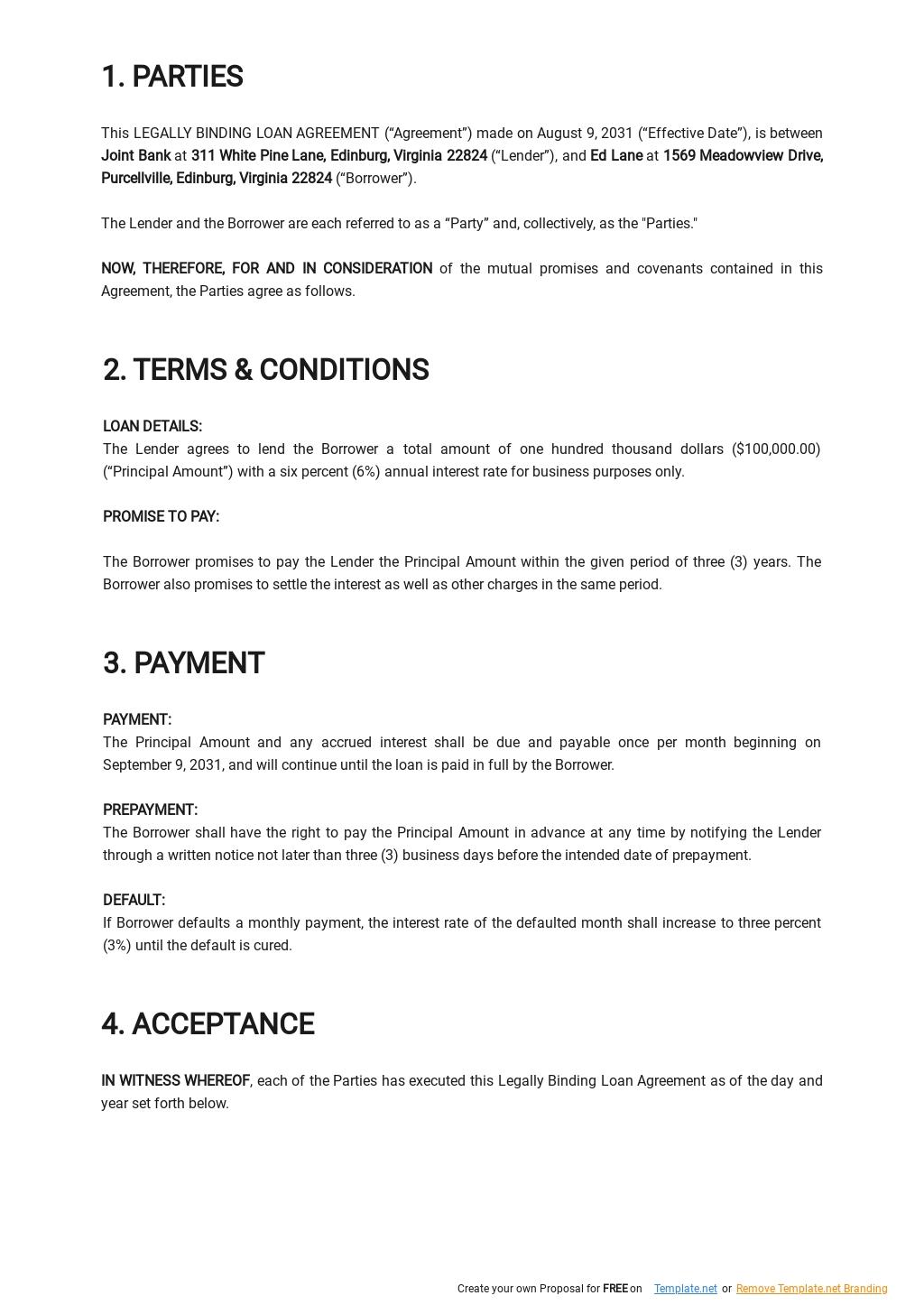

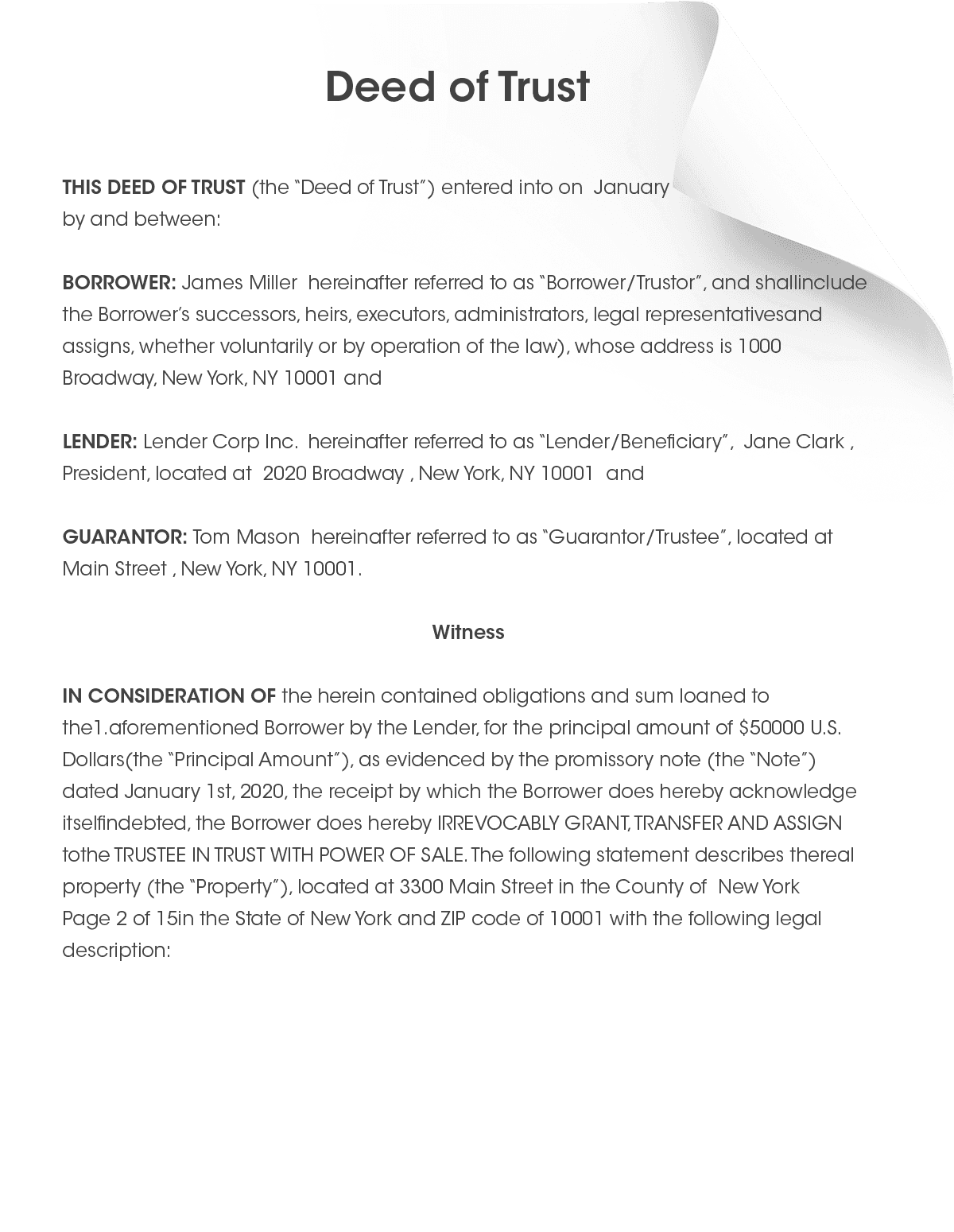

Estate Preparation Factors To Consider For Local Business Proprietors You need to always consult a lawful and/or tax expert to discuss your one-of-a-kind situation to establish what might be a finest technique for you. They are often used by companies, and they deal with their customers to determine the sort of taxes that will certainly be imposed on their profits and exactly how to avoid paying more than required. Several kinds of attorneys specialize in various locations of taxes regulation, such as business, global, estate planning, real estate, and a lot more. The lawyer will certainly likewise suggest them on what deductions are readily available to them and how they can minimize their tax obligation liability.Determine Possessions And Beneficiaries

Changing consumption will reshape business priorities - EY

Changing consumption will reshape business priorities.

Posted: Sat, 09 Mar 2024 01:28:35 GMT [source]

- Sights shared are as of the date suggested, based on the details offered at that time, and might change based on market or various other problems.

- A tax legal representative is an individual that helps organizations with tax-related lawful matters.

- If you've chosen you intend to develop an LLC or corporation, you'll need to file business documents with the state and pay a filing charge.

- Also if your will is created using an online solution, you require to publish out a copy and sign it yourself and ask two witnesses over age 18 to authorize it.

- Additionally, small companies must ensure that they are cost-free and free from contractor misclassification issues.

Exactly How To Carry Out A Monetary Stress Test For Local Business Proprietors

All companies are required to give a safe working environment for their personnel. If you have greater than 5 team you will certainly require to have actually a formal composed Wellness & Safety and security plan. This consists of a refuge to function, safe accessibility to function, secure systems of job, risk-free equipment treatments, safe interactions between employees, and defense from threats of injury. There can be economic advantages in regards to paying tax obligation by ending up Estate Planning being a limited company, and it can likewise be simpler to acquire financing. It is best to review these particular benefits with an accountant before registering your company. Regardless ‚ hiring the appropriate employees to assist with your company sale can not be neglected. Some states have their own unique regulations wherefore have to be consisted of in a will, so make certain to look into your own prior to composing. If you utilize a software program or online solution, standards will likely be offered you. However if you have properties you wish to delegate your kids, spouse, or various other family members-- or minor kids that will need a guardian-- the absence of a will can complicate things. Utilizing your savings to self-finance your service is an excellent alternative, yet it does consist of risking your life savings. Business owners can become obsessed with their organization, and amidst everything, they forget about their personal life. You will require to recognize that the regulator of your market is and then discover a means to keep your knowledge as much as date to remain compliant. As there are so many insurances to consider, it is helpful to go and talk to a neighborhood insurance broker to examine you have the cover you need. The Association of British Insurers ( ABI) web site has a section to aid you choose the best insurance for your service. This is to protect you from any kind of insurance claims a worker could make following an accident or disease experienced as an outcome of helping you. While the lawful processes covered specify to the UK, the basic groups are most likely suitable no matter where your organization situated. It is not always simple to tell whether you need to head to court or certify to use a various treatment. Some independents choose to work with management support assistance while others go the do-it-yourself course using online devices and tech to generate invoices, track expenses, and bill customers. Planning for how you will certainly manage these duties is a wise action as a brand-new small business proprietor and will certainly enable you to focus your time and focus on customers instead of routine business maintenance. Back-office administration consists of all of the management and support jobs that require to be done to run your service. This consists of filing paperwork, monitoring costs, declaring tax obligations, and invoicing customers. Maintain referring back to your typical company strategy so as not to lose sight of what you desired for. Your business handbook is something you will possibly transform and add to as your organization grows. In short, it is truly a book to sum up just how you do points in your company.Social Links