August 14, 2024

Everything You Require To Find Out About Protecting Your Business In A Divorce

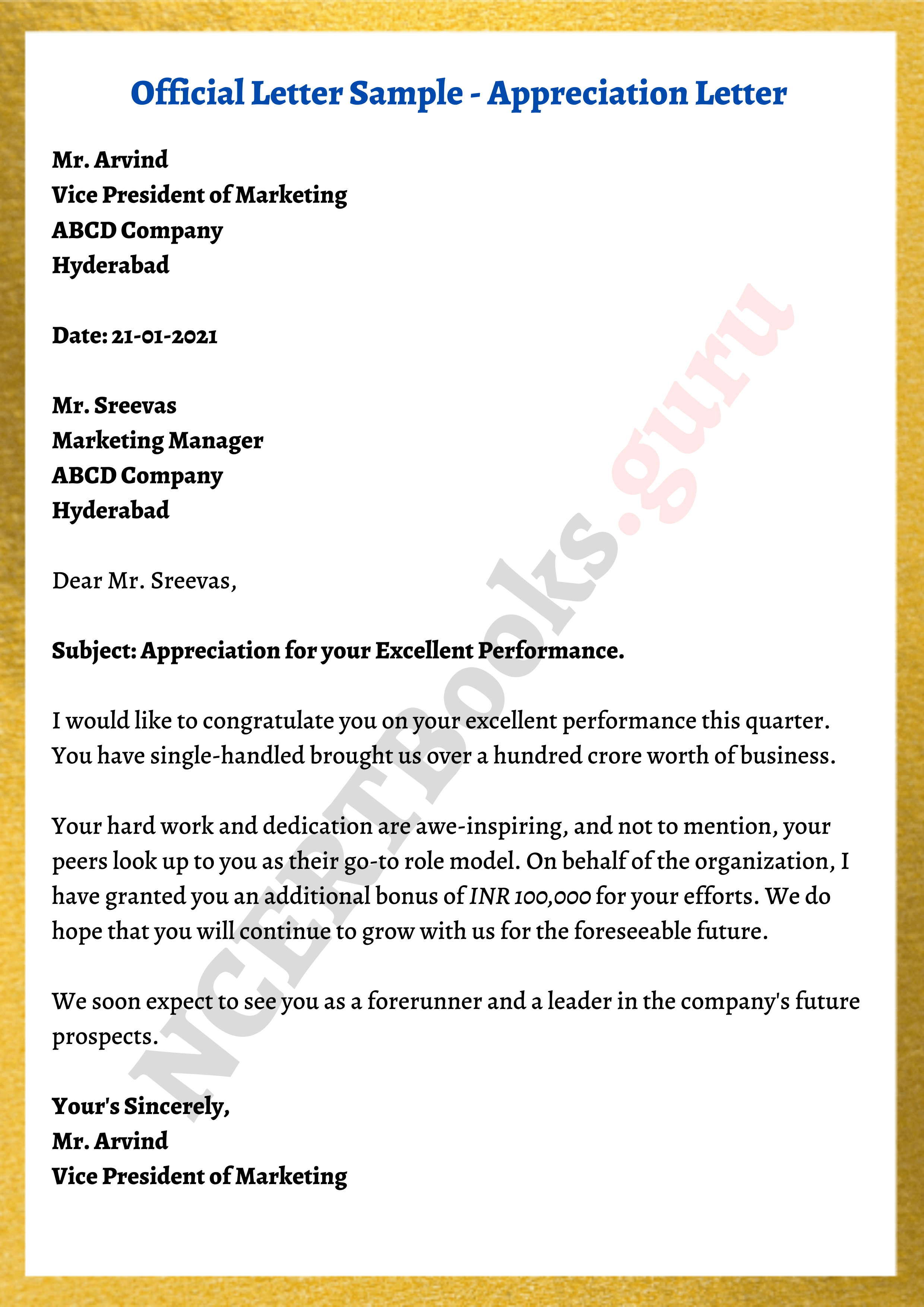

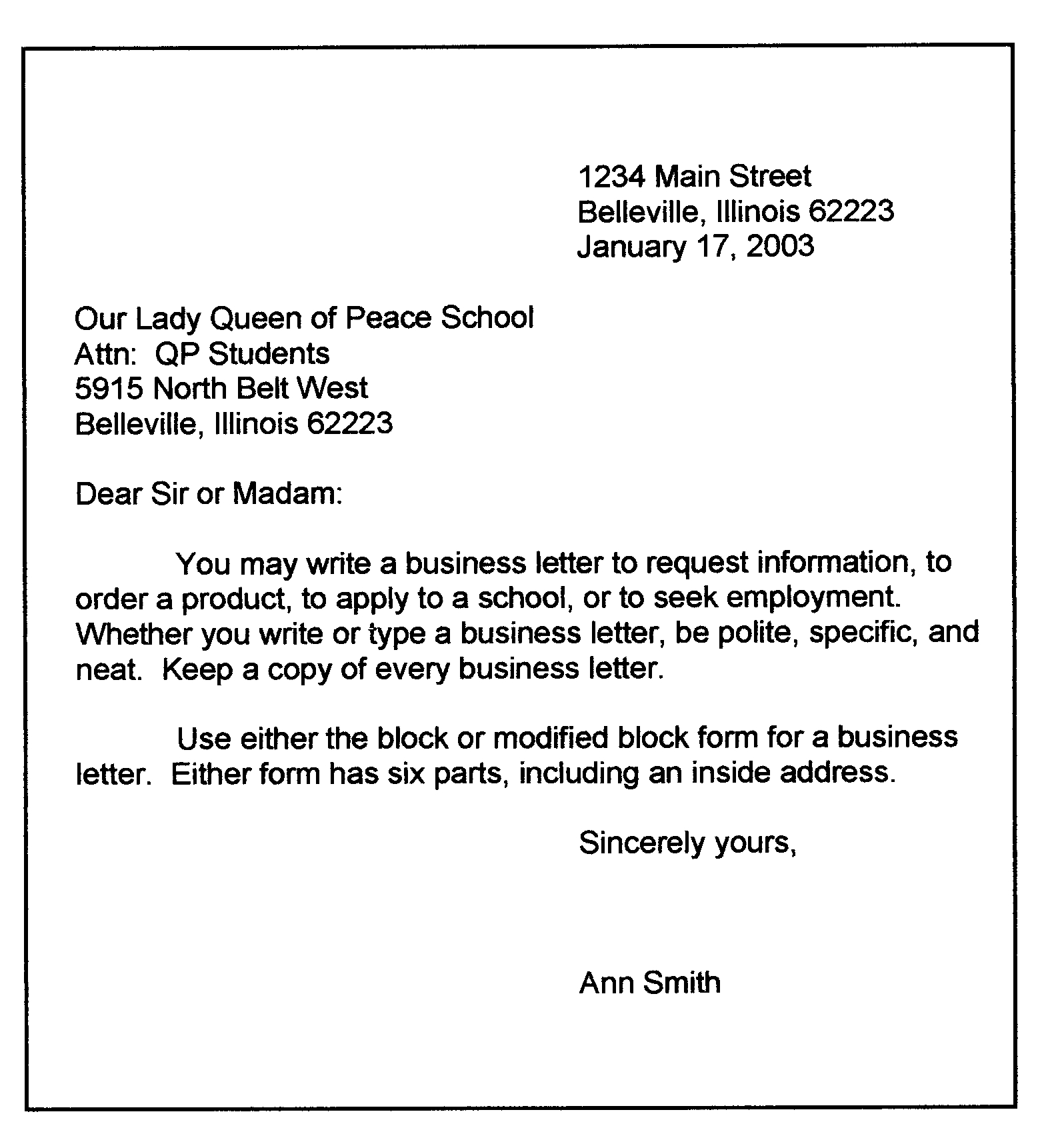

Stay Legitimately Certified U S Small Business Administration And taking care of the courts and the property of someone that has actually died is really made complex. Sometimes, nonetheless, household or family members may have the ability to move residential or commercial property from somebody that has passed away without going to court. Be as clear as possible about that ought to obtain which assets and certain in describing the possessions. Usage complete names and likewise think about including a secondary beneficiary in case you outlive the first. For example, as opposed to writing "my home mosts likely to my son," jot down the complete address and his complete, lawful name. You can record guidelines concerning problems ranging from exactly how the business will be valued (there are a broad series of appraisal methods) to just how its possessions will certainly be divided.Get Satisfaction For You And Your Household Bycreating Your Will Certainly Today

You will certainly require to recognize that the regulator of your industry is and afterwards find a method to keep your understanding up to day to stay certified. As there are so many insurance coverages to consider, it is valuable to go and talk to a neighborhood insurance broker to inspect you have the cover you need. The Association of British Insurers ( ABI) web site contains an area to help you pick the right insurance policy for your company. This is to safeguard you from any type of insurance claims an employee might make complying with an accident or disease endured as an outcome of helping you. While the lawful procedures covered are specific to the UK, the basic categories are most likely relevant despite where your business located. It is not always very easy to inform whether you need to head to court or certify to make use of a different procedure.- This is the person who will disperse the residential property, pay any kind of continuing to be bills and financial obligations, and deal with probate (transferring the titling of possessions).

- Legislations are guidelines and regulations that you have to abide by whilst running your organization.

- Just how the estate is dealt with will partially depend on whether the decedent died with a will or without one.

- You typically require to sign up with HMRC within 4-weeks of taking on your very first worker.

Create A Compliance Plan

Depends on are legal entities produced by individuals referred to as grantors (also called trustors or settlors) that are assigned possessions and instruct in the personality of those assets. A trustee is assigned by the count on paper to manage and disperse those possessions to recipients, according to the desires of the grantor as outlined in the file. You don't require a lawyer to develop a lawfully acknowledged and accepted living will. As a matter of fact, medical facilities or your state federal government can provide living will certainly types to you. By considering the special demands and difficulties faced by local business owner, you can create a customized estate plan that encompasses both individual and service passions. Bear in mind, estate planning is a recurring procedure, and regular evaluations and updates are required to Types of Wills maintain your plan existing and lined up with your developing conditions. Look for expert advice and involve crucial stakeholders to guarantee a smooth transition and a protected future for your service. Estate planning for entrepreneur in New york city State includes various lawful, monetary, and tax factors to consider. This is the most convenient choice when there is more than one local business owner, and 2 or more people share the costs, threats, and obligations. You do not have to have equal shares and everyone's obligation is proportionate to their share. It is not constantly uncomplicated to determine who heirs or recipients are. Entrepreneur require to shield their service assets from possible threats, consisting of lawsuits and creditors. Take into consideration utilizing lawful approaches such as developing a count on or developing a minimal responsibility company (LLC) to shield your service assets from personal liability. A lawyer focusing on organization legislation and estate planning can assist you via the best methods for possession security. As a company owner in New York State, making the effort to develop a detailed estate plan is critical for shielding your service, assets, and loved ones.What Is Shopify and How Does It Work? (2024) - Shopify

What Is Shopify and How Does It Work? ( .

Posted: Sat, 12 Jan 2019 13:40:20 GMT [source]

Social Links