August 7, 2024

Whatever You Require To Learn About Securing Your Service In A Divorce

What Sorts Of Lawyers Do You Need For Your Organization? Learn Right Here Blog Site And taking care of the courts and the residential property of somebody that has actually passed away is really made complex. Sometimes, nevertheless, household or relatives might have the ability to move building from someone that has passed away without litigating. Be as clear as possible concerning who should get which properties and particular in describing the assets. Use full names and also think about consisting of an additional recipient in the event you outlast the very first. As an example, as opposed to writing "my home mosts likely to my boy," document the complete address and his complete, lawful name. You can document guidelines regarding problems ranging from how the business will be valued (there are a broad range of appraisal approaches) to exactly how its properties will certainly be separated.Tax Obligation Advantages

In 2024, for a legally couple, typically each spouse would have the $13.61 million federal estate tax exclusion. A thorough estate plan would also include arrangements addressing what would certainly happen in the event of a simultaneous fatality. Nonetheless you might want to develop what's called a twin will to divide your business possessions - this is not called for, and is solely for the function of lowering probate fees at the time of your passing away (see following area). This material has actually been assessed by Canadian estate preparation professionals or lawyers. Our content team is committed to making certain the accuracy and currency of content related to estate planning, on the internet wills, probate, powers of attorney, guardianship, and various other relevant subjects. Our goal is to give trustworthy, current details to help you in understanding these complicated topics.- As an example, most restaurants require to on a regular basis renew health and wellness certificates.

- Review Simplified Procedures to Transfer an Estate to discover different means to move residential property that do not entail going to court.

- On top of that, whether your organization made a significant earnings during the past year can additionally be an aspect.

- They are typically used by firms, and they work with their customers to establish the kind of taxes that will be imposed on their revenues and how to stay clear of paying greater than required.

What Takes Place To Your House When A Business Owner Passes Away

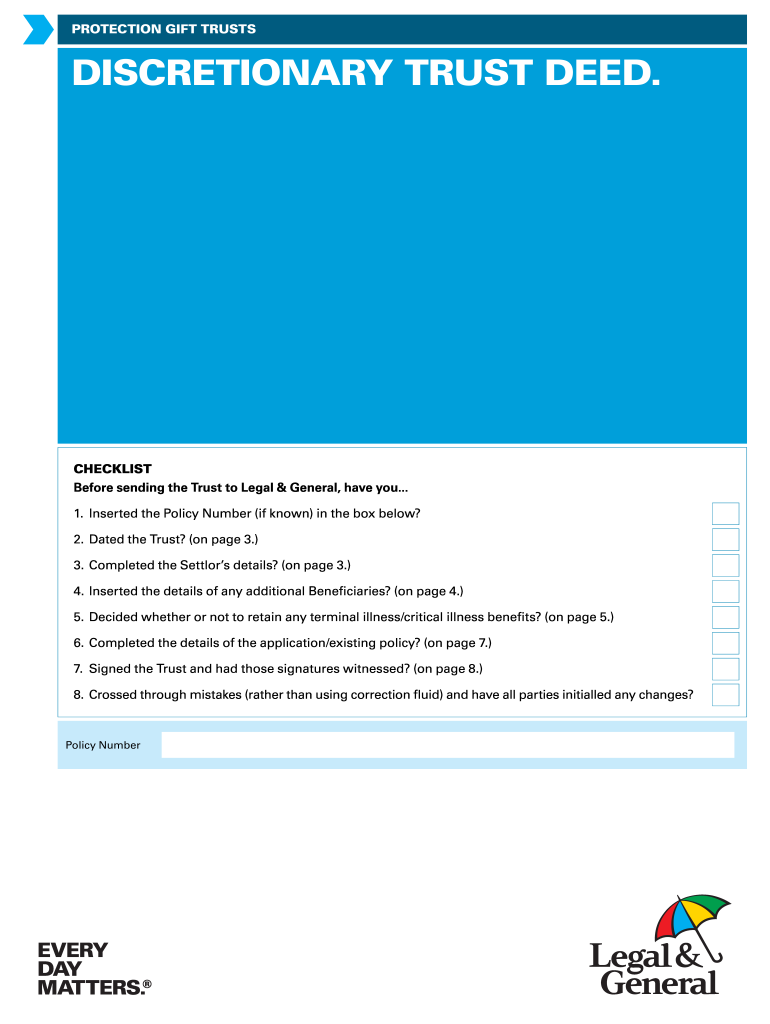

Additionally, a depend on can be either discretionary, permitting the trustee or trustees to determine if, when and to whom to pay revenue and capital, or non-discretionary, where the trust paper stipulates those details. As a result of the individual nature of the partnerships in family-owned organizations, a fatality can be turbulent and destabilizing to the staff members. They will certainly be shocked and depressing, as you are, in addition to worried regarding their work and expert futures, particularly if the death was unanticipated. What occurs with collaborations, limited partnership or restricted responsibility partnerships (LLPs) depends upon the collaboration agreement. Minimal liability companies (LLCs) are required to have an operating contract that includes what occurs in case an LLC owner passes away. The probate legislations in the majority of states separate residential or commercial property amongst the making it through partner and children of the deceased.Minimizing Estate Taxes

Any kind of claims would be declined if you utilize the automobile for business objectives without changing your policy to show this. Accepting settlement by cash money makes monitoring profits a little bit trickier, and might call for maintaining and uploading receipts. You can likewise handle this with your audit software application and add the info to your service economic statements on a monthly basis. You may not have enough money to buy advertising and marketing or advertising and marketing as a self-financed service. Nonetheless, other imaginative ways to make income do not require a considerable investment. Beginning an organization is no small accomplishment; self-financing just adds to the challenge. When developing a service from square one with little to no money, you must be as imaginative as feasible to give it the most effective opportunity of success. Some people obtain prematurely and are inclined to invest the money on things they require right away rather than what they intend to invest it on. People can manage and secure properties during their life time, maintain properties in the family, and decrease tax obligations. This will contains several testamentary trust funds that take effect after your fatality and the probate process (unlike, for instance, a living trust which works throughout your life time). It is utilized in instances where recipients, such as minor kids and/or those with special needs, need details care over an extended period of time. There is absolutely nothing certain in life aside from death and tax obligations, and if you have a business, tax obligation is a considerable component of operating.How to Improve Your Business Writing - HBR.org Daily

How to Improve Your Business Writing.

Posted: Thu, 20 Nov 2014 08:00:00 GMT [source]

Social Links