August 16, 2024

Pour-over Will Certainly Wex Lii Legal Info Institute

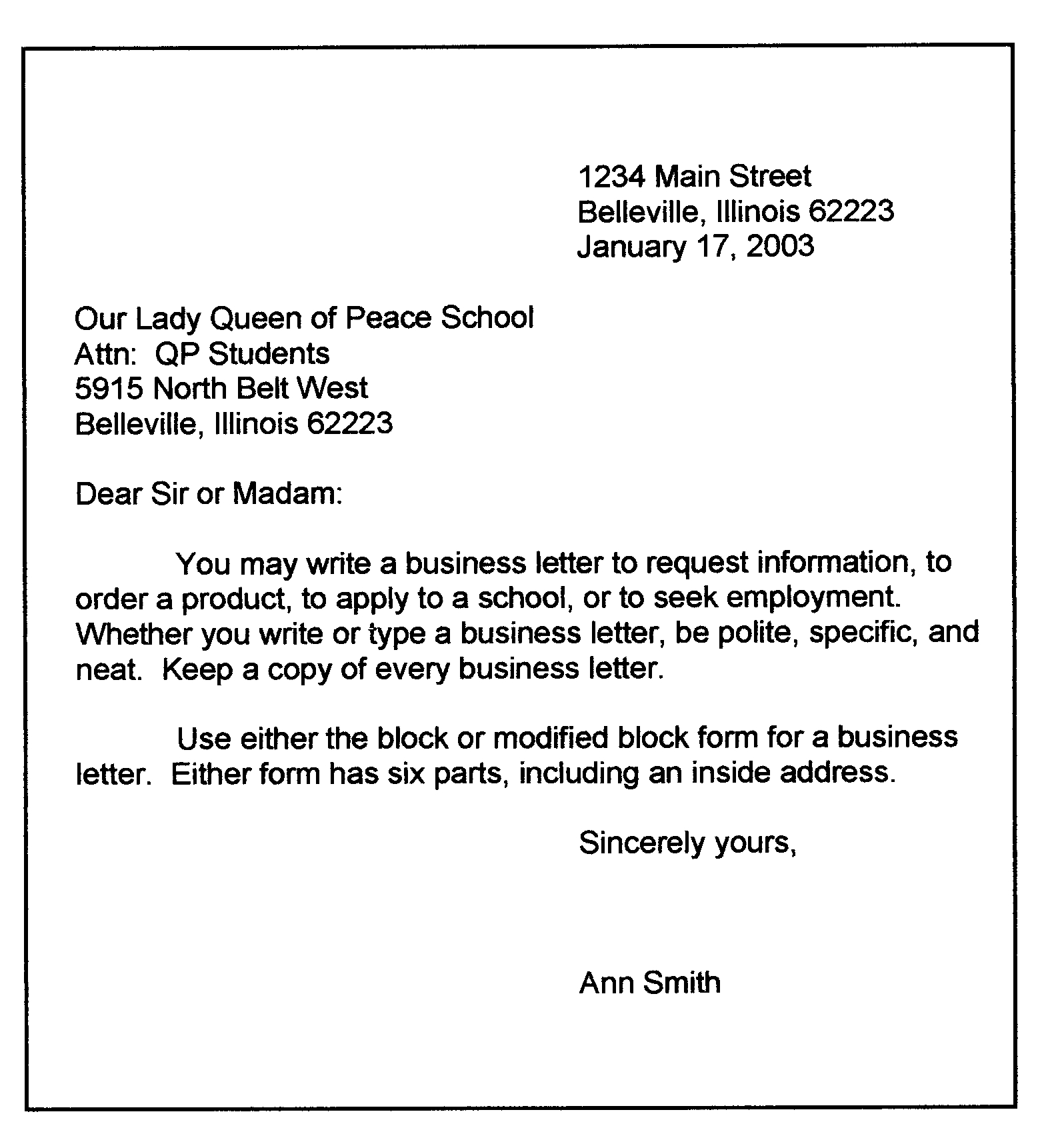

Living Count On And Pour-over Will Certainly: Working In Tandem Insight On Estate Planning Describing the trustee by name, and not as your count on's formal trustee, can lead to your accounts and home passing to them as an individual instead of to the depend on. It can be challenging to see to it every single among your possessions is put in your living trust. You could forget to move some assets or you might just run out of time and die prior to you obtain a chance to relocate them all. Assets captured by a pour-over will certainly have to undergo the regular probate process. Once the probate process is finished, the assets are moved into your depend be managed for and dispersed to your successors. Pour-over wills likewise do not protect your possessions from creditors or litigation.Revocable Depend On Vs Irreversible Depend On: What's The Distinction?

In creating your estate strategy, one option you might go after is developing a revocable living depend on. Throughout your lifetime, you can access the possessions in this sort of trust and likewise make updates to it as required. A revocable living count on additionally helps your liked ones prevent the taxing procedure of probate when you die. Ought to you go this course, you might take into consideration setting up an associated paper known as a pour-over will certainly too. A pour-over will certainly is a last will and testimony that works as a security device to capture any type of properties that are not transferred to or included Click here for more info in a living count on. While "financing" a living trust fund can be a very easy procedure, sometimes assets don't always make it to the trust for a selection of factors.The 4 Best Pour-Over Coffee Makers of 2024 Reviews by Wirecutter - The New York Times

The 4 Best Pour-Over Coffee Makers of 2024 Reviews by Wirecutter.

Posted: Wed, 03 Jan 2024 08:00:00 GMT [source]

Do Pour-over Wills Experience Probate?

It likewise shields possessions from creditors in claims, and properties are exempt to estate taxes. If you're considering establishing one, consult a certified depend on attorney. A pour over will certainly offers many benefits for estate preparation with one of the benefits being that the pour over will assists to utilize the revocable or irrevocable trusts that an individual creates. A Florida Living Trust fund is an additional wonderful tool that permits a person's property to bypass the probate procedure when he or she passes away.- This guide highlights the benefits of a living will and why you need to urge liked ones to produce one.

- And, if you're complete with the transfer of assets made directly to the living count on, the residue ought to be fairly tiny, and perhaps there won't be anything at all that will pass through the will.

- If you did not give guidelines of what occurs to those properties, your state's intestacy legislations would apply.

- With a pour-over will, the testator demand just consist of particular important residential or commercial property in the trust, and all various other building is covered by the will.

What is the function of a spendthrift count on?

Social Links