August 16, 2024

The Duty Of Discretionary Trusts In Your Will

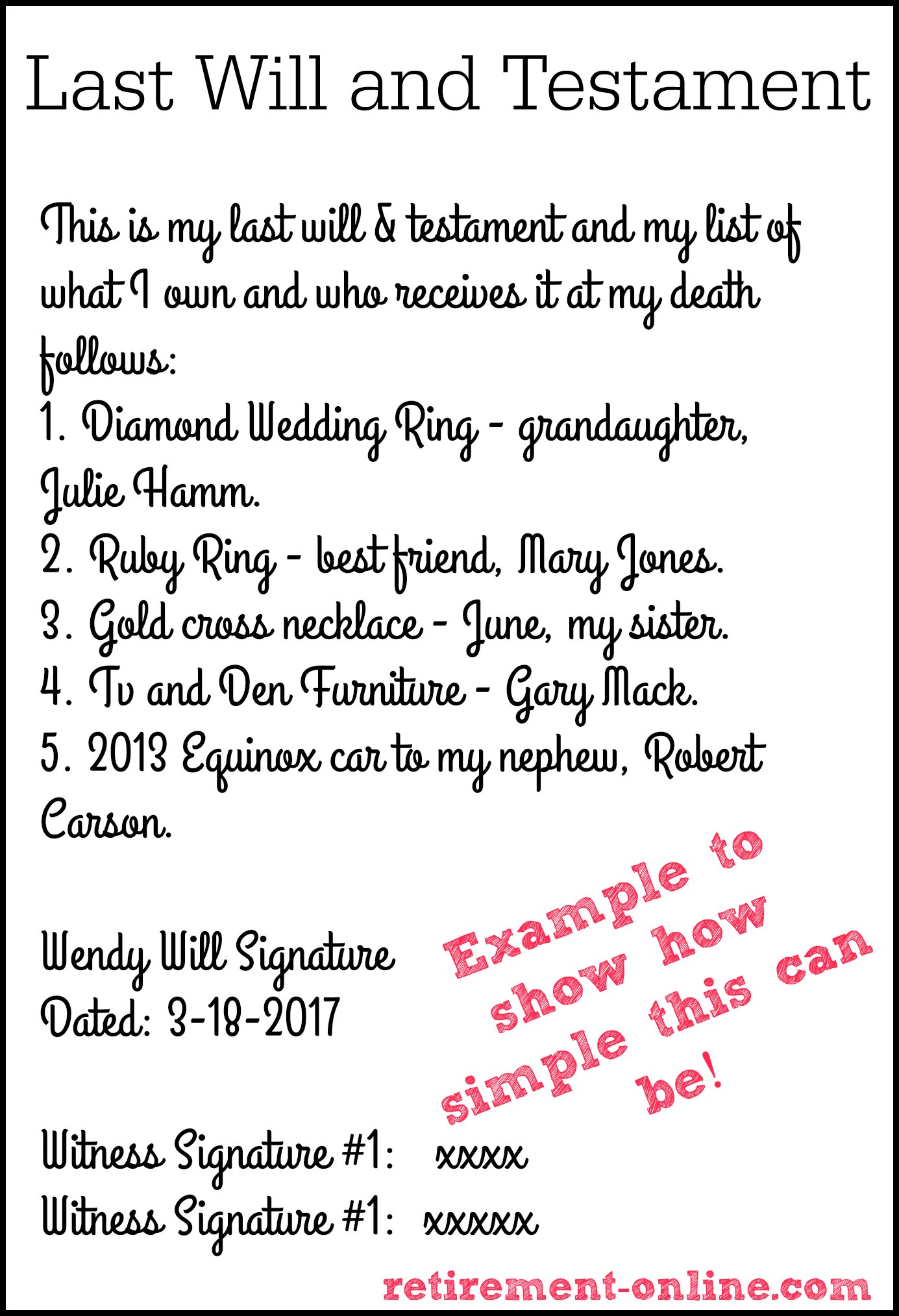

Fixed And Discretionary Trusts Under The Law Estate Planning Legal Facility An usual way to establish an optional trust fund is in a will yet you can also establish one up throughout your lifetime With this kind of depend on, cash and properties are put into the depend on for the benefit of the trust's beneficiaries. Beneficiaries can be called individuals or they can be teams of individuals, such as "my grandchildren." They can likewise include individuals that are not birthed yet.- Discretionary trust funds supply protection against lenders considering that the only way the assets come to be subject to a financial institution is when the funds are dispersed to the recipient.

- Examples might consist of where those you wish to provide for are children, people with finding out difficulties, or individuals that might waste the money in a reckless means.

- The present right into the Way of living Trust is a Chargeable Life Time Transfer for IHT purposes and if the settlor were to pass away within severn years of stating the trust fund the the present continues to be part of the estate for IHT purposes.

- This is usually more effective to a bare or outright trust fund where beneficiaries are fixed and can not be changed.

- The tax obligation rules on non-resident trusts are extremely difficult and beyond the extent of this post.

Shielding Assets

A more use this type of trust fund is that it can guard cash from a recipient who is presently experiencing or likely to undergo a divorce as the funds are treated as belonging to the trust. However, expert advice should be taken if this is the objective as the count on would certainly require cautious monitoring. Do you wish to ensure that your enduring partner will have an income for the rest of their life? Figure out even more concerning just how to attend to your companion with revenue from the trust fund and prevent inheritance tax. The placement with a task to think about exercising discernment in non-exhaustive discretionary depends on is much more complicated, as the task to exercise discernment can be pleased by determining to collect. These sorts of counts on are also generally used by those seeking to trickle feed money to at risk beneficiaries to prevent them from shedding any type of benefits they are entitled to.Requesting Information From Trustees

A permissible beneficiary's equitable property interest under an irrevocable discretionary trust is contingent, not vested ... - JD Supra

A permissible beneficiary's equitable property interest under an irrevocable discretionary trust is contingent, not vested ....

Posted: Fri, 02 Oct 2015 07:00:00 GMT [source]

Leave Cost-- After The Very First 10 Years

A count on is a legal arrangement that involves a settlor, that puts assets right into a depend on fund, which is then managed by trustees for the advantage of a beneficiary or recipients. Various type of assets can be placed in a count on, including cash money, building, shares, device trusts and land. A trust is a legal arrangement in which properties are managed by a trustee in support of one or more recipients. One example is that there is no land tax limit exception for Discretionary Trusts and property can often be kept in a more tax effective way beyond a Trust structure. We do not manage client funds or hold wardship of assets, we assist users get in touch with appropriate financial consultants. This sort of trust can be used by settlors who are not ready to give up accessibility to the funding yet desire Drafting a Will to start IHT planning by cold their obligation on the capital at 40% of the original costs. Although this kind of depend on supplies no IHT benefits for a UK domiciled individual, there are a variety of non-tax advantages which make this sort of depend on eye-catching. It is possible for the settlor to be selected as the protector of the trust. Since under an optional trust, no person beneficiary can be stated to have title to any kind of trust possessions before a circulation, this made optional trusts a powerful weapon for tax organizers. In the United Kingdom, as an example, the Finance Act 1975 enforced a "funding transfer tax" on any kind of building chosen a discretionary depend on, which was changed in the Finance Act 1988 by the estate tax. Having a discretionary trust fund enables an individual to be able to hold onto their assets without the duty of being the legal owner. Companies are needed to pay earnings tax for their take-home pay each fiscal year. Nevertheless, an optional depend on typically does not pay revenue tax obligation, and rather, the beneficiaries pay tax obligations by themselves share to the net income of the count on. In household counts on, the trustee is able to disperse properties to decrease the total tax paid by the family members.Exactly how does a discretionary trust safeguard assets?

Social Links