August 30, 2024

Exactly How To Make A Will Certainly Without An Attorney: Utilize An On The Internet Design Template

The Lawful Demands To Start A Small Business In The Uk Explained When starting with self-financing, it is very important to recognize the alternatives offered- an overview of the most common options and exactly how to decide which one is right for you. It can not be very easy to find the contacts you need to create your brand name without the support of experienced capitalists. Without money, training, or introductions from somebody acquainted with the start-up landscape. They prepare legitimate contracts and examine them before they're authorized by all the parties included. Manage your job's expense, time, invoicing and repayments-- all in one extensive platform. With approximately 15 years of experience and an ordinary client ranking of 4.8 out of 5 stars, you can trust our network attorneys to offer you the aid you require.18 Online Review Statistics Every Marketer Should Know - Search Engine Journal

18 Online Review Statistics Every Marketer Should Know.

Posted: Fri, 13 Jan 2023 08:00:00 GMT [source]

Wills, Estates, And Probate

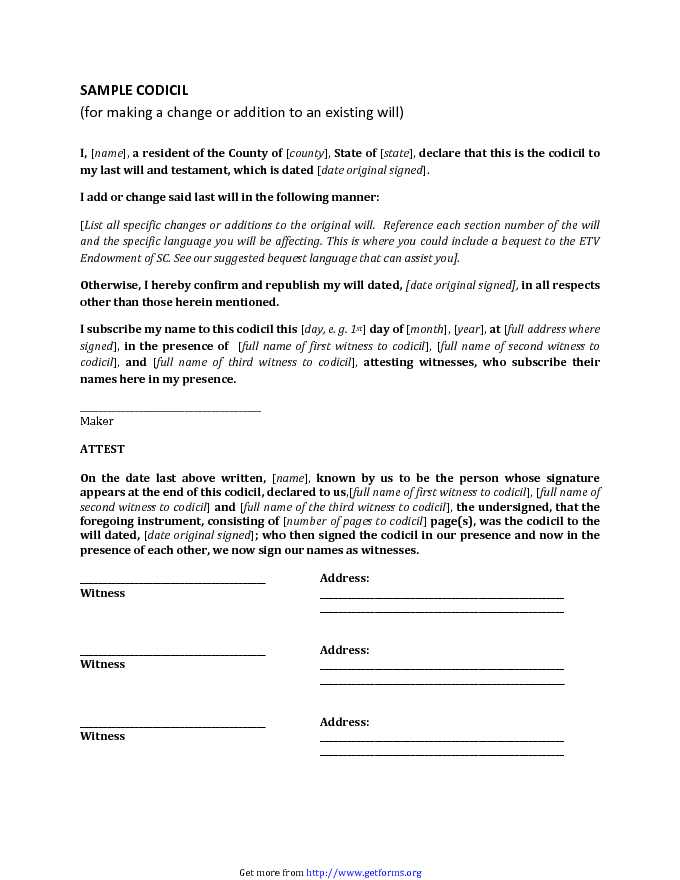

This permits the moms and dads to acquire, offer, profession, or distribute the LLC's possessions. Various other members are limited in their capability to market their LLC shares, take out from the firm, or move their membership in the business. The two primary types of trust funds are a living or "inter-vivos" trust, which is produced and works during the settlor's life time, and a "testamentary" trust fund, which is commonly produced inside a will and enters into play after fatality. E-signature Solutions- The probate legislations in most states separate residential property amongst the surviving spouse and youngsters of the deceased.

- As a collaboration, participants of an LLC report business's revenues and losses on their tax returns, as opposed to the LLC being exhausted as a company entity.

- If you have organization partners, it's important to have a buy-sell contract in position.

- The Fidelity Estate Coordinator ® will certainly guide you with the estate planning process-- free of cost.

- As soon as complete, they will certainly contact you with a ten-digit Special Taxpayer Recommendation (UTR) and send a letter in 2-3 weeks giving you an activation code to access the account.

John And Kelly Learned About Laws And Regulations Their Business Has To Comply With To Guarantee It Operates Legitimately

This overall resets yearly, and the giver pays the taxes as opposed to the receiver. This restriction applies per recipient, so giving $18,000 to every child and various grandchildren would not incur gift tax obligations. Unlike a company, LLC participants can manage the LLC nevertheless they such as and go through less state policies and formalities. As a partnership, participants of an LLC record business's profits and losses on their income tax return, as opposed to the LLC being taxed as a company entity. Binns claims picking the right time to apply an estate freeze relies on factors such as business proprietor's age, family account and finances.Tax Legal Representative

The majority of independent service providers are taken into consideration to be freelance and are therefore subject to paying Self-Employment (SE) Tax Obligation along with revenue tax. SE Tax is both the employer and staff member fifty percents of Social Security and Medicare (FICA). Complying with legal demands is important to guarantee your organization stays certified and lucrative. No, the owner of an LLC is not liable for the financial obligations of the firm, which is among the vital advantages of an LLC. An LLC gives protection to the proprietor from lenders in the event that the company defaults, enters bankruptcy, or otherwise can not make its responsibilities. In a family LLC, moms and dads maintain monitoring of the LLC, with children or grandchildren holding shares in the LLC's assets, yet not having administration or ballot rights.Social Links