August 19, 2024

Interest Needed! Cloudflare

Living Depend On Vs Will Certainly: Key Differences We believe every person must be able to make economic decisions with self-confidence. NerdWallet, Inc. is an independent publisher and contrast solution, not a financial investment advisor. Its posts, interactive devices and other content are supplied to you free of cost, as self-help tools and for educational objectives only. NerdWallet does not and can not assure the precision or applicability of any type of info in relation to your private situations. Instances are theoretical, and we encourage you to look for customized guidance from certified professionals pertaining to specific investment problems. Our price quotes are based on past market performance, and previous efficiency is not an assurance of future performance.Do I Need A Will If I Don't Have Much Money?

- Remember, the only variation of your will certainly that matters is the most present valid one out there at the time of your death.

- No matter which route you require to create your Will, there are some basic steps you intend to require to guarantee you're covering whatever you require, so your last dreams will certainly be recognized and followed.

- Next, the grantor transfers possession of their properties and building to the living trust account.

Significant Life Events And Scenarios

You should be offered a duplicate also, which must be kept with your individual records and must plainly suggest who holds the authorized will. You can select to hold onto the original-- if you pick to do so just keep it somewhere safe where a loved one or close friend can locate it. When it comes to writing a will, you're truly just establishing the future for individuals you enjoy the most.What Happens If I Die Without A Lawful Will?

It's this pivotal duty that highlights the relevance of producing a will and having the needed estate planning papers in place. An irreversible trust fund permanently eliminates assets from your estate and gives them to the depend on. This permanent transfer of ownership hence takes the properties out of your ownership in the eyes of the internal revenue service, leaving you with a smaller sized estate (and, as a result, possibly much less estate tax). Remember that irrevocable trust funds are permanent once they're signed and funded, so the assets in the depend on, and the beneficiaries you name, can not be changed. The beneficiary details you place on particular financial accounts generally takes top priority over the beneficiary details you put in your will certainly or depend on. It might likewise be a good idea to set aside a normal time, perhaps every other year or so, where you assess your will even if no huge modifications have taken place in your life. You may be stunned at what possessions you take into consideration essential sufficient to define 2 years in the future. Also, your point of views on beneficiaries and needs regarding asset division may transform. At the least, it is an excellent way to proceed considering the future. Handwritten wills are known as "holographic wills." Holographic wills are not accepted in every state and can conveniently be ruled void by the court.7 Prime benefits that will save you money - About Amazon

7 Prime benefits that will save you money.

Posted: Tue, 06 Jun 2023 13:03:38 GMT [source]

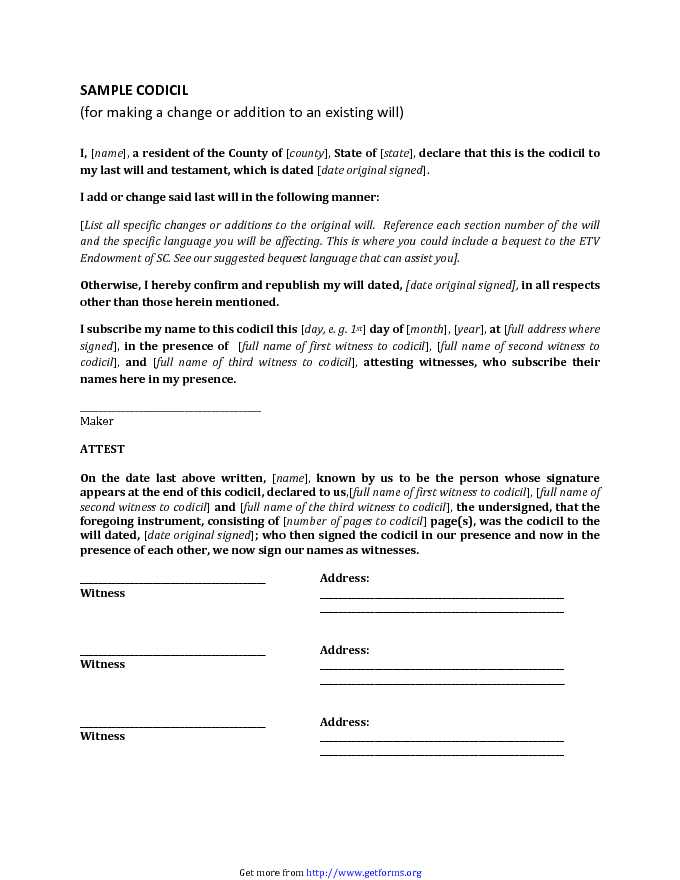

What is a will instance?

I, ________________________, a local in the City of ____________________, Region of ____________________, State of ____________________, being of sound mind, not acting under duress or unnecessary influence, and totally comprehending the nature and level of all my building and of this disposition thereof, thus make, ...

Social Links