August 25, 2024

Pour-over Wills

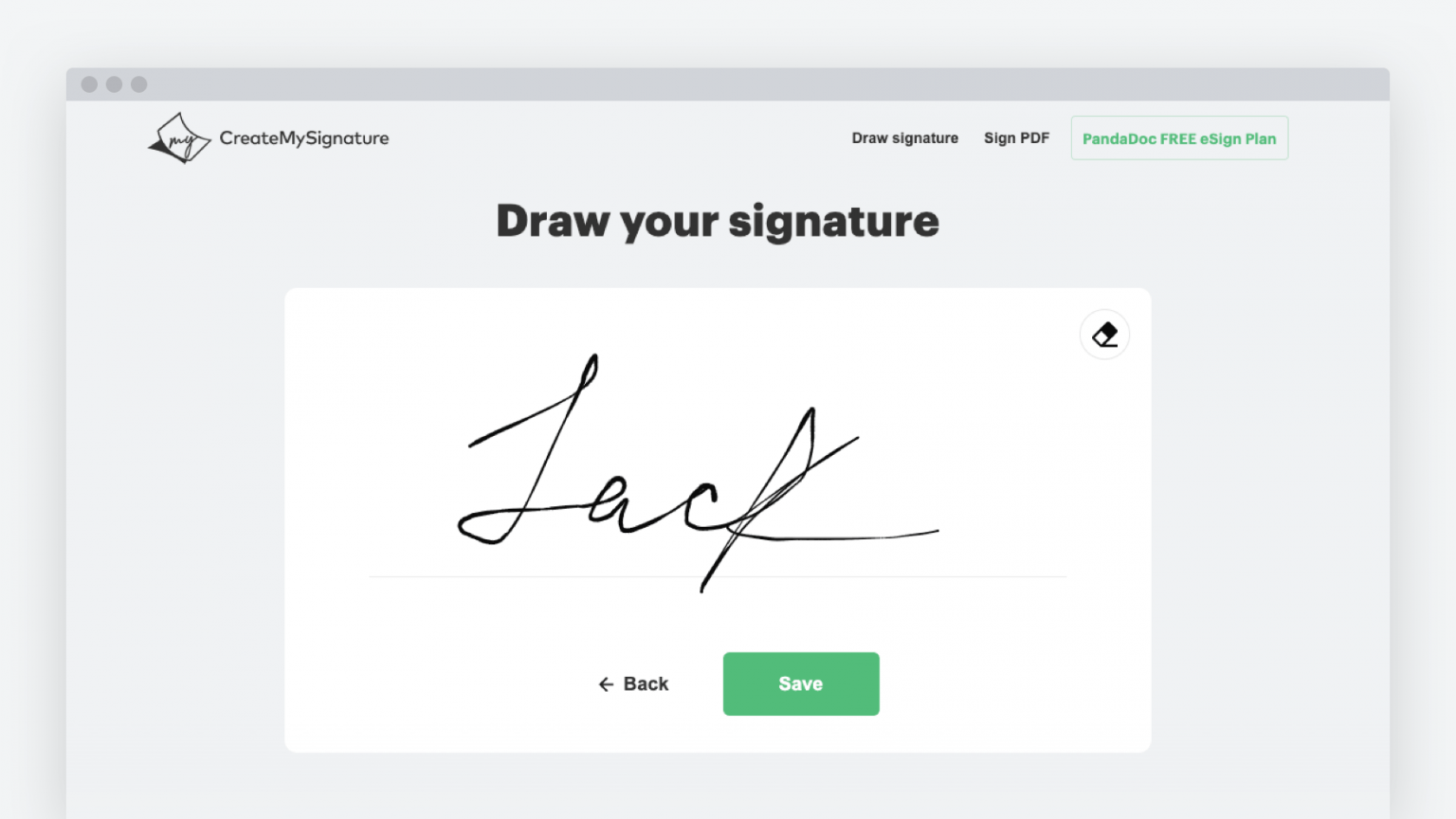

Pour-over Wills Jacksonville Estate Preparation Lawyers Regulation Office Of David M Goldman Trust & Will is an online solution supplying legal forms and information. A pour-over will certainly and revocable count on operate in tandem, so you will require both if you 'd such as for your pour-over will to work. If you do not plan to establish a living trust fund, or if whatever you own is already put in a trust, you may not need a pour-over will.Utilizing A Pour-over Will Certainly And Revocable Count On Estate Preparation

A revocable count on is a kind of count on that can be withdrawed, changed, or upgraded if needed. It's a positive alternative if you wish to establish a living trust fund, and predict the requirement to make changes or like having flexibility. This is as opposed to an irrevocable trust, which does not enable any changes to be made. Our overview explaining the difference between revocable and irrevocable trust funds highlight their particular advantages and downsides. Both revocable and unalterable trust funds can be pricey to create, intricate to reverse, in the case of an irreversible trust fund, and costly to revise, in the case of a revocable trust fund. It is very hard to dissolve an irreversible trust, and a revocable count on doesn't necessarily protect your properties from financial institutions.Obtain Help With California Estate Preparation

Matching it with a pour-over will certainly can help wrangle any loose possessions that you purposely (or unintentionally) really did not move to the living trust fund. A pour-over will certainly is yet another estate preparation alternative that better ensures the security of your possessions. If you have actually developed a trust, or strategy to https://seoneodev.blob.core.windows.net/personal-will-service/legal-will-preparation/will-lawyers/what-is-a-will133892.html start one, you might want to think about adding a pour-over will. Some people purposely pick not to position all their assets right into their depend on at one time. All of these are likely circumstances in which a pour-over will include a layer of security. A pour-over will certainly is a lawful record that makes sure a person's staying possessions will immediately move to a previously established depend on upon their fatality.- You may have seen current information coverage of clients of financial services companies succumbing social engineering frauds.

- If you work in a profession where you might be at danger for lawsuits, such as a medical professional or attorney, an irrevocable trust fund can be helpful to secure your assets.

- Living depends on can help you stay clear of probate, yet can be difficult to fund, that's why a pour-over will is a good safety and security gadget to protect designated recipients.

- However, pour-over wills are subject to some constraints and might be invalidated under certain situations.

How Do You Create A Pour-over Will?

A pour-over will is a kind of will certainly with a stipulation to "pour" any kind of extra or unallocated possessions in a person's estate right into a living trust when the person dies. The idea is to decrease the probate procedure and guarantee that assets are distributed as the departed wishes. Let's say you have 2 youngsters and 4 grandchildren to whom you intend to leave all of your properties after you are gone. Tina's work has actually shown up in a range of local and national media electrical outlets. Our team believe everybody needs to have the ability to make monetary choices with self-confidence. Please do not consist of any type of personal or sensitive info in a contact form, text message, or voicemail. Likewise, if you own residential property, have kids, have actually just recently been wed or separated, or want to make a certain gift it is important to create or update your Florida Will. Our Jacksonville, estate planning lawyers, can help see to it that home is distributed according to your dreams. A number of the top Jacksonville estate-planning attorneys utilize a Florida Pour Over Will to compliment a revocable, living, or unalterable count on. A pour-over will certainly in Florida transfers every one of an individual's residential or commercial property and properties, that are subject to probate, into the decedent's count on when she or he dies. The property transferred into the depend on is then dispersed to the beneficiaries of the depend on by the depend on's terms. Before ending up being an editor, she covered small business and taxes at NerdWallet. She has actually been an economic author and editor for over 15 years, and she has a degree in money, as well as a master's level in journalism and a Master of Business Management. Previously, she was an economic expert and director of finance for several public and private firms.Theater legend Hal Prince leaves behind at least $5.2 million - New York Post

Theater legend Hal Prince leaves behind at least $5.2 million.

Posted: Thu, 22 Aug 2019 07:00:00 GMT [source]

What is the distinction in between a revocable and irrevocable trust?

Social Links