August 16, 2024

Pour-over Wills In California The Law Firm Of Kavesh Minor & Otis, Inc

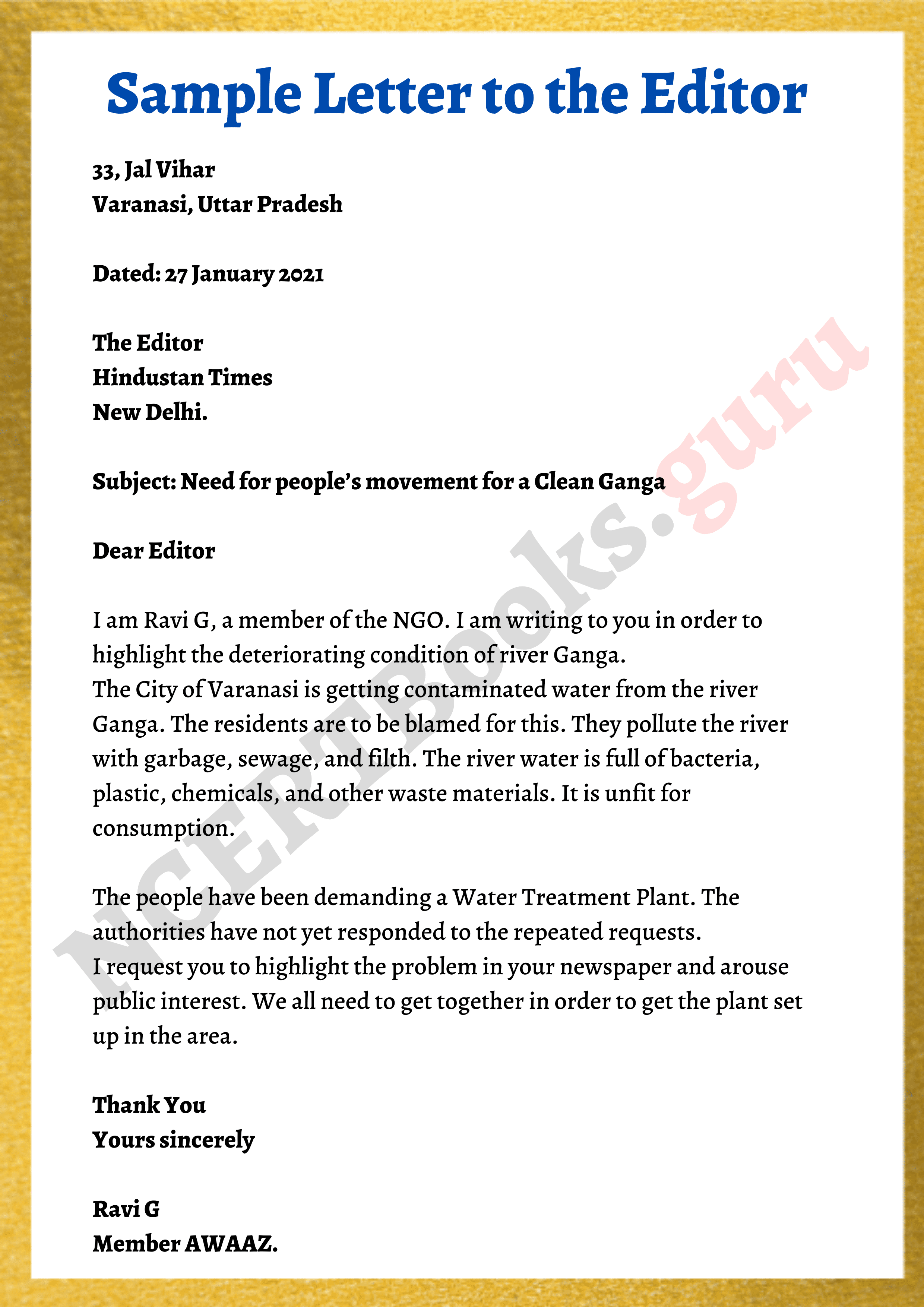

Pour-over Wills In California The Law Firm Of Kavesh Small & Otis, Inc The pour-over will certainly form need to be consistent with the count on and might call the count on as a beneficiary. Ensure that naming the depend on as the recipient has no negative tax obligation ramifications by reviewing your particular circumstance with a cpa. In 2002, Gabriel Katzner, the founding companion of Katzner Legislation Group got his Juris Doctorate with honors from the Fordham College College of Legislation. After spending the very first 7 years of his lawful careerpracticing at Cahill Gordon & Reindel LLP, a global law office based in New York, he took place to discovered his own company. But they will likely have less assets than a routine will, or possessions of significatively less worth.Do You Need To Speak To An Estate Preparation Attorney?

It's not uncommon for an individual to make use of a trust fund as opposed to a will for estate preparation and stipulating what takes place to their assets upon their death. Trusts are likewise a means to lower tax obligation problems and avoid assets going to probate. A trust is a separate lawful entity an individual establishes to hold their possessions. Counts on are established throughout an individual's life time to guarantee that assets are made use of in such a way that the individual establishing the count on regards ideal. Once assets are placed inside a count on, a 3rd party, known as a trustee, handles them.Using A Pour-over Will And Revocable Count On Estate Preparation

Guide to Wills and Estate Planning - New Hampshire Magazine

Guide to Wills and Estate Planning.

Posted: Mon, 05 Feb 2018 08:00:00 GMT [source]

- Simply put, they will certainly need to go via the probate procedure and will certainly go through estate tax.

- Please reference the Terms of Use and the Supplemental Terms for specific info related to your state.

- Trust funds are established during a person's lifetime to assure that possessions are used in such a way that the person setting up the trust fund deems suitable.

What Are The Benefits Of Making A Living Trust With A Pour-over Tool?

NerdWallet does not and can not assure the precision or applicability of any details in regard to your private circumstances. Instances are theoretical, and we encourage you to seek personalized recommendations from certified professionals pertaining to specific investment issues. Our quotes are based upon previous market performance, and previous performance is not a guarantee of future efficiency. As the name recommends, a pour-over will certainly takes all the assets you possess in your sole name at the time of your fatality and "puts" them right into the trust fund you have actually developed. Basically, these uncomplicated files leave all of your properties to your trust to be dispersed according to the terms of your count on. This is why anyone utilizing a depend on for testamentary purposes ought to also make use of a Florida Pour Over Will. This post will discuss the advantages of having and the feasible repercussions of not having a pour-over will. There are lots of advantages to a trust besides staying clear of probate, and the possessions that are already in the trust at your fatality will certainly prevent probate. It is only those properties that need to be dispersed by means of the pour-over will certainly that will certainly have to go through probate.Does a pour-over will avoid probate in Florida?

Social Links