August 27, 2024

Discretionary Count On Probate Will Certainly Writing Leicester Will Writing Solutions London Long Lasting Power Of Attorney Uk

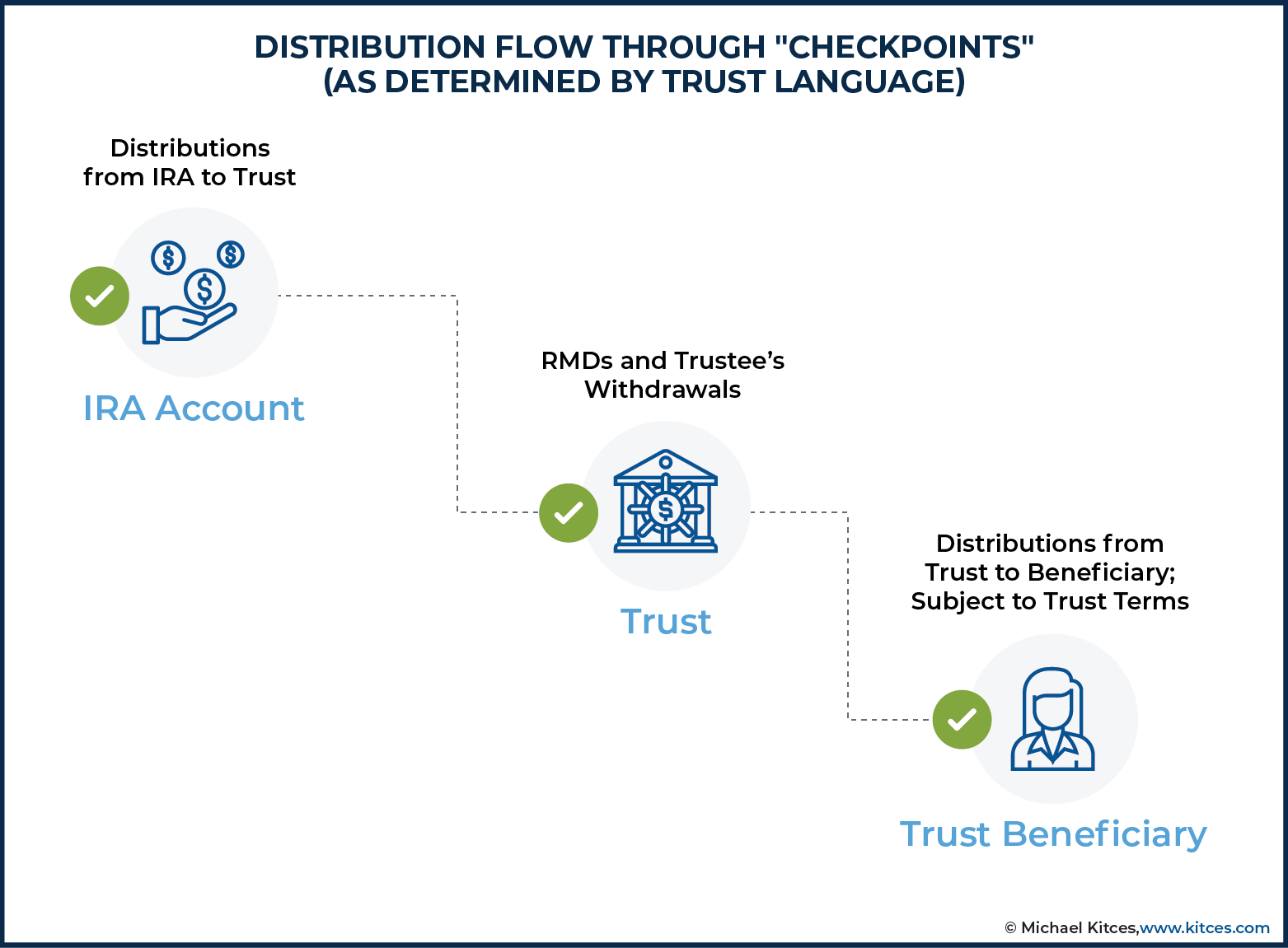

Discretionary Trust Wikipedia When establishing a depend on, making use of a discretionary trust gives peace of mind as a result of the protections this kind of trust supplies to your enjoyed ones that might not have the skills needed to secure the properties you provide to them. Generally, when making a Will, you call people that you want to get your estate when you pass away, called your recipients. However, there might be circumstances where you would certainly favor that your estate doesn't go straight to the recipients when you die, however rather, that it is held on behalf of those beneficiaries in a particular way. Individuals holding the assets in behalf of the beneficiaries are known as your trustees. Trustees are nominated in the Will to provide the trust fund in your place. For additional information, please enter contact so that one of our lawful professionals can discuss this with you.Who to trust with your Trusts? - Legal Futures

Who to trust with your Trusts?.

Posted: Fri, 02 Dec 2022 08:00:00 GMT [source]

Repaired And Discretionary Trusts Under The Regulation

However, in instances where a settlor is additionally a beneficiary, the beneficiary may be tired on any income arising to the trustees. A discretionary trust fund can be produced when the settlor lives, or in their will. Optional depends on can seem strange on the face of it however there are numerous reasons why they may be an integral part of your estate preparation. The ATO describes Depends on as "a defining attribute of the Australian economy" and has actually estimated that by 2022 there will more than 1 million Count on Australia.Inquiring From Trustees

Nonetheless, this is most likely to trigger added cost to the estate so we would certainly recommend the primary residence is dealt with separately in the Will. Last but not least, it can be utilized to safeguard money from a beneficiary that is undergoing a separation. The advantage of entering their share of the estate in this count on is that the trust fund funds will certainly not be dealt with as coming from the beneficiary as the depend on possesses the assets and will certainly as a result drop outside of the beneficiary's estate. As we have actually already pointed out, the trustees of a Discretionary Count on have the ability to exercise their judgement. They can decide what and when a beneficiary obtains, so it's essential that the trustees are people you can trust. This need to be somebody, or an entity, that you can trust to act in good confidence. It generally needs to also be somebody who has demonstrated their trustworthiness and loyalty in time, together with their financial astuteness. Lots of individuals like to consider their closest loved ones participants as feasible Trustees. The vital function of a Discretionary Depend on is to give optimal defense for the funds held in the Count on, and to the better advantage of its beneficiary or beneficiaries. In spite of the many benefits, however, there are some circumstances where a Discretionary or Household Trust is not the much better choice for investing or holding residential or commercial property. For example, they can provide food coupons to the recipient which will certainly ensure it can just be invested in certain products. If the beneficiary lives in rental lodging, for example, they can arrange to pay the proprietor straight. Our group of experienced lawyers is constantly readily available to offer extensive assistance and expert advice. The information consisted of in this update is for general information functions only and is illegal suggestions, which will certainly depend upon your certain conditions. Holding funds in the count on will certainly likewise protect the cash from the beneficiary's creditors or potential personal bankruptcy. They have control over just how much to disperse at any type of given time, when to make distributions and that to make them to. No specific recipient has a rate of interest in the trust or an entitlement to the trust fund funds-- they only have a possible passion until the trustees in fact exercise their discretion in their favour. Optional depends on are specifically suitable for individuals who are happy to leave choices concerning the monitoring and circulation of the fund's assets to trustees. Although a discretionary depend on can be made use of to reduce IHT, the possibility for the settlor's estate and trustees to be strained in various methods ought to not be neglected. Trustees have the supreme say in just how a discretionary count on is provided, highlighting the significance of choosing trustees carefully. We intend to provide fresh concepts, clear and simple explanations, and a solution tailored specifically to you. With you at the centre, we strive to make the will composing procedure as clear as possible. It is not feasible for a useful trust or a resulting depend develop as an optional trust fund. Our professional legal representatives have significant experience in creating and administering depends on for our customers. Most of all, one of the most important thing is to make sure your Will certainly harmonizes your family situations and that it supplies satisfaction. Beneficiaries of a Discretionary Trust do not have any type of lawful insurance claims over the Count on funds.- It is possible to select a member of the family or a good friend, but it is vital that they understand their lawful obligations and certainly fulfil any reporting requirements.

- This can be accomplished by leaving a letter of desires in addition to your will, laying out the scenarios in which you would like your recipients to get their properties.

- This happens on every 10th anniversary of the depend on until every one of the possessions of the trust have been distributed to the recipients.

- If trustees disperse revenue to a recipient, relying on the kind of optional trust and the beneficiary's tax rate, the beneficiary might have the ability to declare tax back on count on income they've obtained.

- A family members depend on has a range of benefits for an individual's possessions on asset security and tax obligation reasons, in addition to assurance.

- If it is a couple who are setting up the count on you increase up the nil price band.

Does an optional trust need greater than one beneficiary?

1. Only naming a solitary beneficiary. A crucial element of a discretionary trust fund is that there need to be multiple prospective beneficiaries who can gain from it.

Social Links