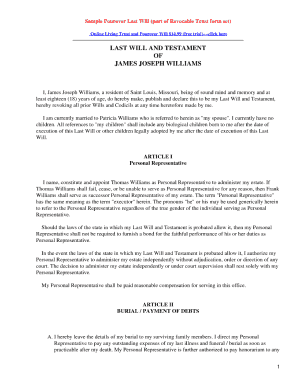

Pour Over Wills Under The Law Estate Planning Legal Center

Pour-over Wills Jacksonville Estate Preparation Legal Representatives Regulation Workplace Of David M Goldman Dealing with a lawyer to draft this record can likewise be useful to guarantee you satisfy all needs to create a valid will certainly so your instructions are followed upon your fatality. When you create a living depend on, you must fund it by re-titling properties so the count on becomes the official owner. However it is really feasible that you will not do this with everything you possess. Note that if you keep back just things of minor value for the pour-over part of the will, your family members may gain from an expedited procedure. In some states, your estate might get "small estate" probate, often referred to as "summary probate." These procedures are simpler, much faster and less costly than routine probate. In numerous states, your will certainly have to be transferred with your state notary's workplace within a certain timeframe following your death.Revocable Count On (living Count On)

A revocable trust fund is a sort of trust fund that can be revoked, customized, or upgraded if required. It's a favorable choice if you wish to develop a living count on, and anticipate the need to make changes or like having adaptability. This is rather than an irrevocable trust fund, which does not permit any modifications to be made. Our overview clarifying the difference between revocable and irrevocable trust funds highlight their corresponding advantages and disadvantages. Both revocable and irrevocable depends on can be pricey to formulate, intricate to undo, when it comes to an unalterable trust fund, and pricey to reword, in the case of a revocable count on. It is very tough to liquify an irrevocable count on, and a revocable count on does not always safeguard your assets from lenders.This Popular Kind Of Will Certainly Goes Together With A Living Depend On

This can lead to beneficiaries needing to wait longer to get their trust fund circulations. When you develop a pour-over will, you (the testator) name a beneficiary. The beneficiary receives any kind of accounts and property that you own in your Beneficiary name alone at the time of your fatality. They might also serve in the three-way roles of recipient under your will, trustee of your count on, and administrator. The distinction between a simple will certainly and a pour-over will is that a simple will certainly is implied to handle your entire estate, such as by leaving it to your spouse or your youngsters.- You might have seen current information coverage of customers of economic services business succumbing social design rip-offs.

- If you work in an occupation where you may go to danger for lawsuits, such as a medical professional or attorney, an unalterable count on might be useful to shield your properties.

- There's no such thing as being too ready when it pertains to your Estate Plan.

- Living counts on can assist you prevent probate, but can be complicated to fund, that's why a pour-over will is an excellent safety and security tool to safeguard intended beneficiaries.

Estate Planning with Portability in Mind, Part II - The Florida Bar

Estate Planning with Portability in Mind, Part II.

Posted: Wed, 04 Apr 2012 07:00:00 GMT [source]

What is the most effective trust to prevent inheritance tax?

. This is an irrevocable trust fund into which you place possessions, again shielding them from estate taxes. A Living Will only becomes reliable if you are determined to have an incurable disease or go to the end-of-life and when you are no longer able to interact your dreams. In New York City State, the Living Will certainly was accredited by the courts (not by regulations )so there are no requirements assisting its use. As quickly as this takes place, your will is lawfully legitimate and will be accepted by a court after you die. Wills do not end. These papers merely state your options about what you want to occur to your home and other passions after you die. An irreversible trust fund supplies you with even more defense. While you can not change it, financial institutions can not conveniently make cases against it, and assets held within it can normally be passed on to recipients without being subject to estate tax. You do not avoid probate with pour-over wills as they still experience probate, and the count on can not be dissolved throughout the probate process. While the properties that pour over