August 30, 2024

What Is A Will, And How Do You Write Your Own?

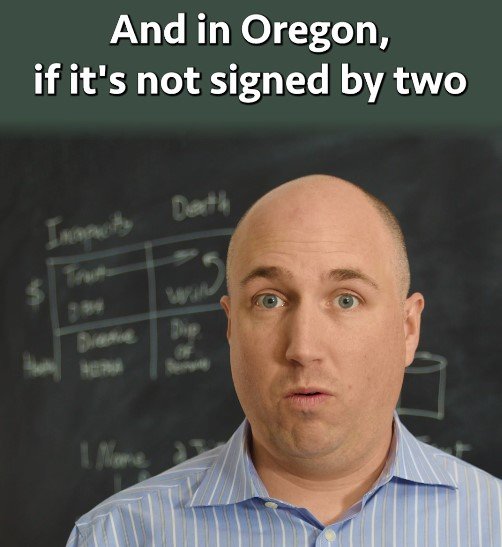

Living Wills And Development Regulations For Clinical Choices You and at least 2 other people should authorize it to make it a legitimate will. Your signature will certainly show you intend this paper to be your last will and testament. The two other individuals should authorize the record as witnesses to validate your trademark. Keep your will certainly in a safe place, so your executor can find it when they need to begin distributing your properties. You must likewise make duplicates of the record and give them to your administrator and anyone else you think ought to have one.Request Estate Planning Guide

A recipient is an individual designated to get something from an estate or trust fund. Put simply, a recipient is anyone you're leaving property to in your will. You can call anybody or establishment (such as a charity) to be a recipient in your will. As soon as you've called your recipients, you'll have to choose what property they must receive.How Typically Can I Transform My Will?

- If the decedent has made previous arrangements for a burial story or funeral service expenditures, those need to be specified in this area.

- No states requires notarization, though that may expedite the probate procedure.

- In case of the initial companion's fatality, the staying spouse may not make any modifications to the will.

- The absence of an initial will can make complex issues, and without it, there's no assurance that your estate will be settled as you desire.

- In states that permit the documents, the will certainly have to satisfy very little demands, such as proof that the testator wrote it and had the mental ability to do so.

We And Our Partners Process Information To Give:

Some people think that they do not own enough possessions or have a big sufficient total assets to demand a will. AARP is a not-for-profit, detached organization that encourages individuals to select exactly how they live as they age. Any person can act as a witness to your will, as long as they're "disinterested." In other words, the individual who witnesses your will certainly need to obtain no take advantage of it. You, like others, may not totally comprehend exactly how a will certainly jobs, why you require one and what a difficult mess you will certainly pass off upon your liked ones if you fail to leave this vital file. To be legitimate, your will have to have two witnesses and meet various other criteria, as required by your state. The person you name to execute your desires is your "executor," who will certainly pay your final bills and distribute your properties to recipients. A will must be admitted to probate when a person passes away having residential property in his or her name alone or as lessees in common. Such joint building passes instantly to the making it through joint owner or owners. Your will certainly might be submitted with the Register of Wills for safekeeping for an one-time fee of $5.00. This may include the visibility of witnesses or composing the spoken will after stating it. Holographic Discover more wills are handwritten forms testators compose without witnesses or legal oversight. Will manufacturers have a tendency to write them under extreme or life-threatening circumstances. Like basic wills, they usually focus on the distribution of properties. Nonetheless, courts might consider them invalid without witness trademarks. The exact same will likely make an application for any financial investment accounts that are marked as "transfer on death." You can distribute your possessions with many different ways while reducing your threat and tax obligation responsibility. If you have an intricate estate strategy, a lot of useful properties, or simply want to ensure your will certainly is totally right, you can work with an estate preparation lawyer.What is going on with Jada Pinkett and Will Smith? Their marriage has never been about just them. - Vox.com

What is going on with Jada Pinkett and Will Smith? Their marriage has never been about just them..

Posted: Tue, 17 Oct 2023 07:00:00 GMT [source]

What does wills do?

Social Links