September 18, 2024

Discretionary Count On Wex Lii Legal Info Institute

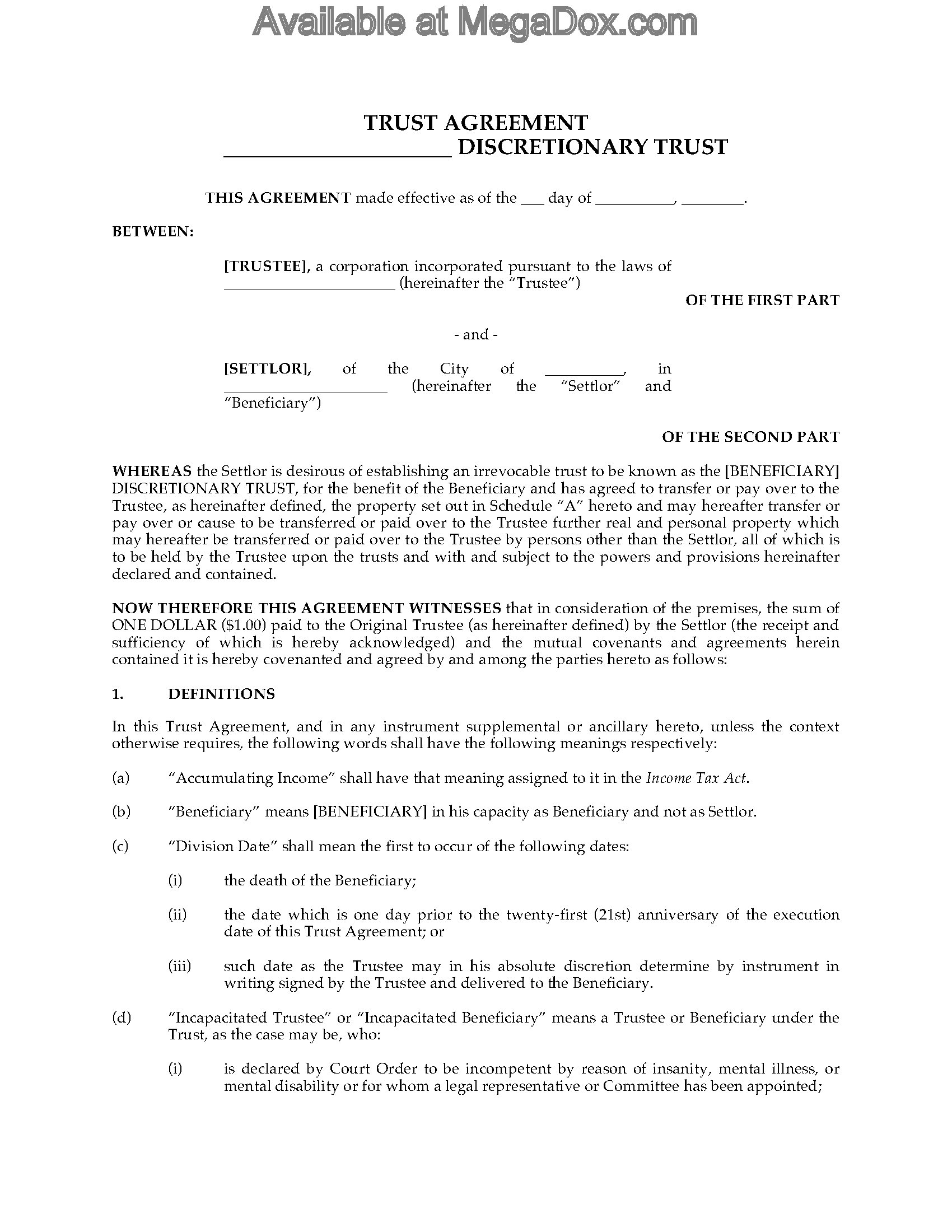

Optional Trust Fund Probate Will Certainly Creating Leicester Will Certainly Composing Solutions London Enduring Power Of Lawyer Uk In a regular count on setup, properties are handled according to the directions and desires of the trust fund developer or grantor. For instance, you might specify that your youngsters should wait till they graduate university or turn 30 before they can access trust fund possessions. In the United States, an optional recipient has no legal proprietary passion in a depend on. Discretionary count on the UK likewise permit adaptability in the determination of the circulation of possessions to individuals. Let us take the instance of a widower, Mr Brown, who has lately passed away.

- Beneficiaries do not have any legal privilege to properties in a discretionary trust fund and consequently they don't create component of their estate on separation, personal bankruptcy or fatality.

- Gifts right into discretionary trust are classified as chargeable life time transfers (CLTs).

- A discretionary trust fund can be used to ensure agricultural residential property relief or company residential or commercial property relief is made use of.

Solutions

Nevertheless, the original capital is still significantly in the estate for IHT objectives until it has actually been repaid to the settlor and invested. Versatility is maintained for the trustees (in some cases with the advice of a protector) to distribute or loan resources to beneficiaries at any time in the future. This is often preferable to a bare or outright trust fund where recipients are repaired and can not be changed.

Just How Do You Establish A Discretionary Trust?

Discretionary trusts now have 'substantial sting in the tail' - SMSF Adviser

Discretionary trusts now have 'substantial sting in the tail'.

Posted: Wed, 26 Feb 2020 08:00:00 GMT [source]

It's possible to pick a trustee that is also a recipient of your estate, however it's great practice to make certain that you appoint at least one trustee who does not stand to take advantage of your estate. A Discretionary Count on is a great choice for your Estate Plan if you wish to shield assets for your recipients, however can not determine a collection schedule for how these properties must be distributed. Possibly there are unknown variables, or you can think about circumstances in which you wouldn't desire your enjoyed ones to get their distributions. Rather, you can provide your Trustee the discernment to establish how much and when those circulations need to be made. The trust fund will be subject to routine IHT costs used on every 10th wedding anniversary of the trust fund's development. Capitalists are suggested to take independent professional recommendations before impacting transactions and the costs of stocks, shares and funds, and the revenue from them can fall. Tax therapy depends on individual situations and may undergo change in future. We do not support or accept duty for web site web content on any kind of sites aside from those run by Courtiers, which may be accessible via web links in this write-up. Different regulations apply where a trust is an optional funding trust fund or a reduced present strategy, or where a life insurance policy policy is held in a discretionary count on. These policies are complicated, so it is always best to talk with an Economic Consultant. Trustees are likewise in charge of paying tax obligation on earnings gotten by optional depends on. Your desire is to leave her your estate, however you are fretted that she would have accessibility to large sums of cash when it comes to a regression situation. It keeps you up in the evening stressed that she can possibly squander her inheritance for the objective of drugs and alcohol. You decide to establish a Discretionary Trust with your daughter's godfather as the Trustee. This should be someone, or an entity, that you can depend act in great faith. It typically must also be a person who has demonstrated their reliability and loyalty gradually, in addition to their monetary astuteness. Lots of individuals like to consider their closest family and friends participants as possible Trustees. The crucial function of a Discretionary Count on is to offer maximum protection for the funds held in the Trust, and to the better benefit of its beneficiary or beneficiaries. Regardless of the many advantages, nonetheless, there are some circumstances where a Discretionary or Household Depend On is not the far better alternative for investing or holding residential or commercial property. Further, the beneficiaries have no claim to the funds, indicating that they can not try to force the Trustee to distribute funds. Most of the times, Trusts are set up with details terms that instruct the Trustee to disperse funds to beneficiaries on an established schedule. Optional Depends on are distinct from various other types of Trust funds since there are no such terms. It is up to the Trustee to make a decision if recipients must get any type of circulations, just how much, and when. The sights expressed by Courtiers in this summary are gotten to from our very own research study. Courtiers can not accept responsibility for any kind of decisions taken as an outcome of reading this short article. She or he can not change the recipients or the benefits they are readied to receive. An optional trust is a sort of trust where the trustees are given complete discernment to pay or use the revenue or funding of the properties that remain in the trust, for the advantage of one or every one of the recipients. Of all the numerous types of trust fund, optional trusts are possibly the most flexible. As the name suggests, trustees have full discretion over that the beneficiaries are and the properties they receive and when. This contrasts with bare counts on, where as soon as they get to the age of 18, a called recipient has the outright right to the trust's assets and when they receive them. The flexibility of discretionary depends on suggests they can be adjusted to altering situations, also when the settlor has actually passed, such as a recipient falling on hard times. Instead, your picked trustee can use their discernment to make a decision when to make possessions from the depend on readily available to your kid. An optional depend on can be established throughout a person's life time. or within their Will to take effect when they pass away. The individual setting up the count on is referred to as the settlor, and they will prepare the letter of desires. A trust fund is a legal arrangement in which possessions are held by an individual (or individuals), referred to as the trustee( s), for the advantage of several recipients. There are various sorts of trust, each with their very own special features, objectives, benefits and tax obligation effects. Throughout the life cycle of a discretionary trust the trustees, the settlor's estate, settlor and occasionally the beneficiary may be liable for various tax fees. As the trustees are allowed complete discernment regarding exactly

https://us-southeast-1.linodeobjects.com/family-will-services/wills-and-probate-services/inventory/indeed-you-need-a-will-and-an-estate-strategy.html how the trust is managed, this enables a lot of flexibility. It may be that when the settlor makes their Will, they are not sure of exactly how things will look when they pass away. The flexible nature of a discretionary trust fund implies that it can be upgraded to mirror transforming circumstances. The letter of dreams can be upgraded as usually as the settlor picks without the requirement to modify the trust.

Why would certainly you set up a discretionary trust fund?

A key element of an optional trust fund is that there have to be multiple potential beneficiaries who can gain from it. In most cases, Trust funds are set up with specific terms that advise the Trustee to distribute funds to recipients on an established routine. The terms also usually established just how much ought to be dispersed. Optional Counts on are unique from various other types of Depends on since there are no such terms. On each 10-year anniversary, the depend on is exhausted on the value of the trust much less the nil price band readily available to the trust, with the price on the excess being 6%( determined as 30 %of the life time rate, presently 20% ). If the trust worth is much less than the nil rate band, there will certainly be no charge. Beneficiaries of an optional trust fund are not qualified to obtain anything since right. Rather the beneficiaries have the possible to obtain money and the right to ask the trustees to exercise their discretion in their favour. If an optional count on is established throughout the settlor's lifetime, the assets within that depend on might drop outside their own estate if they die at the very least 7 years after placing the assets right into the trust fund. This will have the effect of reducing down the general worth of their estate when it is evaluated for inheritance tax. A lifetime optional depend on or life passion depend on developed to hold money or investments will certainly