Tips for Maximizing Dental Insurance Benefits

Looking to make the most of your dental insurance benefits? We’ve got you covered! In this guide, we’ll provide you with valuable tips on how to maximize your coverage and save money on dental expenses.

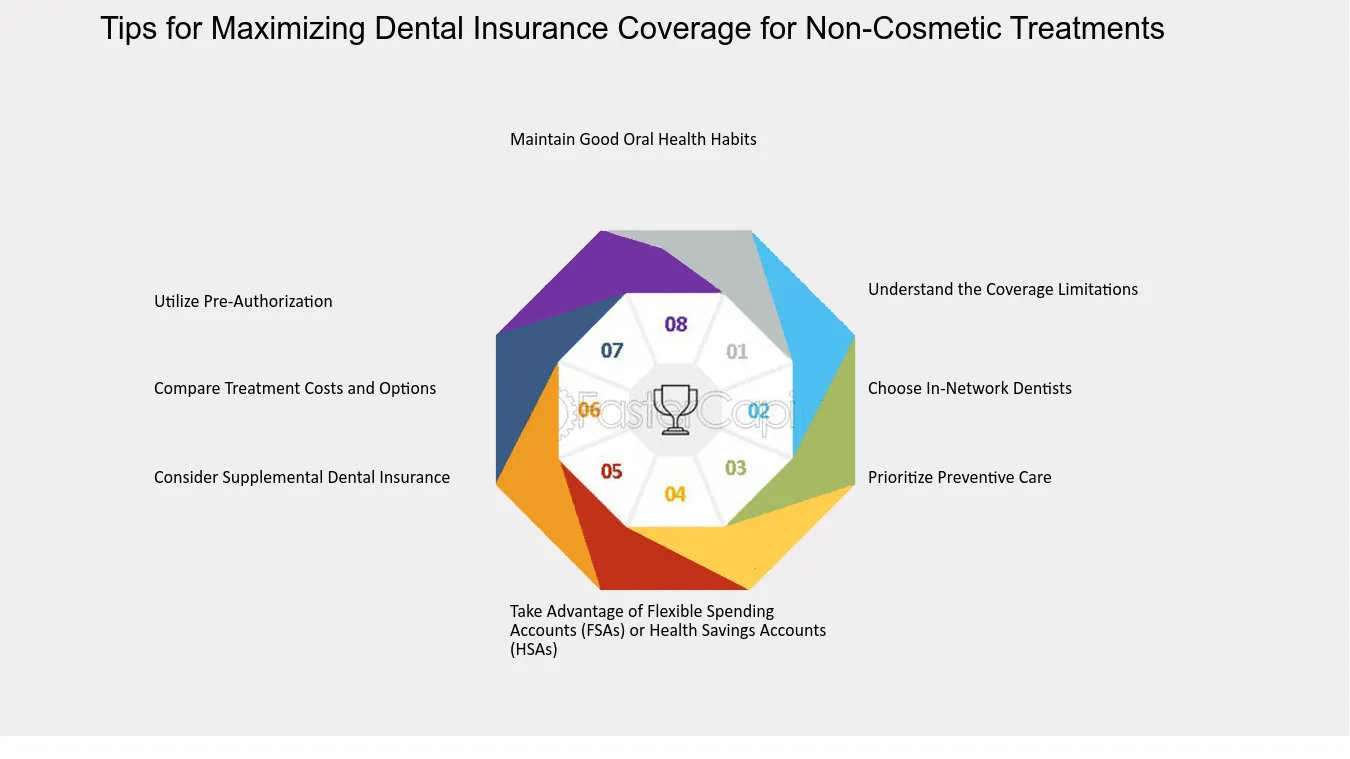

By understanding your dental insurance coverage and taking advantage of preventive care benefits, you can ensure that you’re getting the most out of your plan. Additionally, choosing in-network dentists can help you save on costs, while maximizing your annual maximum benefit can provide you with extra coverage when you need it most.

Don’t forget to utilize flexible spending accounts for dental expenses to further optimize your insurance benefits. With these tips, you’ll be well-equipped to make the most of your dental insurance and maintain a healthy smile.

Key Takeaways

– Review dental insurance policy documents

– Schedule regular dental check-ups and take advantage of covered cleanings and X-rays

– Choose in-network dentists to benefit from negotiated lower rates and higher coverage levels

– Utilize flexible spending accounts to save money on dental expenses and prioritize oral health without financial burden

Understand Your Dental Insurance Coverage

To fully maximize your dental insurance benefits, you need to understand the coverage provided by your dental insurance plan. It’s important to familiarize yourself with the specifics of what’s covered and what’s not, as this will help you make informed decisions about your dental care.

Start by reviewing your dental insurance policy documents. Look for information on preventive care, such as cleanings and exams, as these are typically covered at a higher percentage or even fully covered. Understanding these benefits can encourage you to prioritize regular dental visits and maintain good oral hygiene habits.

Next, take note of the coverage for restorative treatments, such as fillings, root canals, and crowns. These procedures may be covered at a lower percentage, requiring you to pay a portion out-of-pocket. Knowing these details can help you budget for any necessary dental work and avoid surprises when it comes time to pay.

Additionally, be aware of any waiting periods or limitations on certain procedures. Some insurance plans have waiting periods before certain treatments are covered, so it’s important to plan accordingly. Also, some plans may have annual maximums or frequency limitations on certain services, so understanding these limitations can help you make the most of your benefits.

Take Advantage of Preventive Care Benefits

Make the most of your dental insurance benefits by utilizing preventive care services. Taking advantage of preventive care benefits not only helps you maintain good oral health but also maximizes your insurance coverage. Most dental insurance plans cover preventive services such as regular check-ups, cleanings, and X-rays at little to no cost. By scheduling these appointments and following through with recommended treatments, you can prevent more serious dental issues down the road and save money in the long run.

Regular dental check-ups allow your dentist to detect any potential problems early on, such as cavities or gum disease. With early detection, these issues can be treated before they worsen, saving you from more extensive and costly procedures. Cleanings help remove plaque and tartar buildup, reducing the risk of tooth decay and gum disease. X-rays provide a comprehensive view of your oral health, allowing your dentist to identify any hidden problems that may not be visible during a routine examination.

Choose In-Network Dentists for Cost Savings

By choosing in-network dentists, you can further maximize your dental insurance benefits. When you visit a dentist who’s in-network, you can take advantage of several cost-saving benefits that can help you save money in the long run. Here are three reasons why choosing in-network dentists is a smart financial decision:

1. Reduced Out-of-Pocket Costs: When you visit an in-network dentist, your dental insurance plan has negotiated lower rates for the services provided. This means that you’ll pay less out of pocket for your dental care, allowing you to save money on each visit. By choosing in-network dentists, you can ensure that you’re getting the most value out of your dental insurance plan.

2. Higher Coverage Levels: In-network dentists have agreed to accept your dental insurance plan’s approved fees for services. This means that your dental insurance plan will cover a higher percentage of the costs, leaving you with less to pay. By choosing in-network dentists, you can maximize your coverage levels and reduce your out-of-pocket expenses.

3. No Surprise Bills: When you visit an in-network dentist, you can rest assured knowing that there will be no surprise bills or unexpected charges. In-network dentists have a clear understanding of what your dental insurance plan covers, so you won’t have to worry about unexpected expenses. Choosing in-network dentists gives you peace of mind and helps you budget effectively.

Maximize Your Annual Maximum Benefit

Utilize your dental insurance’s maximum benefit to its fullest potential. Your annual maximum benefit is the maximum amount of money that your dental insurance will pay towards your dental care for a specific period, usually a calendar year. It’s important to understand and make the most of this benefit to ensure you receive the dental treatment you need without incurring excessive out-of-pocket costs.

To maximize your annual maximum benefit, start by scheduling regular dental check-ups and cleanings. These preventive visits are typically covered at 100% by insurance and can help identify any potential issues before they become more serious and costly to treat.

Additionally, if you require any dental treatment, such as fillings, crowns, or root canals, it’s wise to plan and schedule them strategically. By coordinating your treatment plan with your dental insurance coverage, you can maximize your benefits by spreading out the treatments over multiple calendar years. This way, you can utilize your annual maximum benefit fully each year and minimize your out-of-pocket expenses.

Furthermore, take advantage of any unused benefits before the end of the year. Dental insurance benefits typically don’t roll over to the following year, so if you have any remaining benefits, make sure to use them before they expire.

Utilize Flexible Spending Accounts for Dental Expenses

To make the most of your dental insurance benefits, consider using a flexible spending account for covering dental expenses. A flexible spending account (FSA) is a tax-advantaged account that allows you to set aside pre-tax dollars to pay for eligible healthcare expenses, including dental treatments. Here are three reasons why utilizing an FSA can be beneficial for your dental needs:

1. Save money: By using an FSA to pay for dental expenses, you can save on taxes. The money you contribute to your FSA is deducted from your paycheck before taxes are calculated, reducing your taxable income. This means you’ll pay less in taxes overall, saving you money in the long run.

2. Easy budgeting: With an FSA, you can plan for your dental expenses in advance. You can contribute a specific amount from each paycheck to your FSA, ensuring that you have funds set aside specifically for dental treatments. This makes it easier to budget and manage your dental expenses throughout the year.

3. Cover a wide range of dental treatments: FSA funds can be used for a variety of dental treatments, such as cleanings, fillings, extractions, braces, and even cosmetic procedures like teeth whitening. Having the flexibility to use your FSA funds for a wide range of dental procedures allows you to prioritize your oral health without worrying about the financial burden.

Frequently Asked Questions

What Should I Do if My Dental Insurance Coverage Does Not Include Certain Treatments or Procedures That I Need?

If your dental insurance coverage doesn’t include certain treatments or procedures that you need, there are a few steps you can take.

First, talk to your dentist and see if there are alternative options that are covered.

You can also consider asking for a pre-authorization from your insurance company to see if they’ll make an exception.

If all else fails, you may need to explore other financing options or discuss a payment plan with your dentist.

Can I Use My Dental Insurance Benefits for Cosmetic Dentistry Procedures?

Yes, you can use your dental insurance benefits for cosmetic dentistry procedures. However, it’s important to note that not all insurance plans cover these types of procedures.

It’s best to review your policy or contact your insurance provider to determine what’s covered. If cosmetic dentistry isn’t covered, you may need to explore alternative payment options or consider a dental discount plan.

How Often Should I Visit the Dentist for Preventive Care Check-Ups?

How often should you visit the dentist for preventive care check-ups?

Regular dental check-ups for preventive care are recommended every six months. These visits help to ensure that any oral health issues are detected early and treated promptly.

During these check-ups, your dentist will clean your teeth, examine your mouth for any signs of decay or gum disease, and take X-rays if necessary.

Will My Dental Insurance Cover Orthodontic Treatment for Adults?

Yes, your dental insurance may cover orthodontic treatment for adults. It’s important to check with your insurance provider to understand exactly what’s covered and any limitations or restrictions.

Orthodontic treatment can be a significant investment, so maximizing your dental insurance benefits can help offset the costs. Consider exploring different treatment options and finding a provider that’s in-network with your insurance to ensure you get the most out of your coverage.

Are There Any Restrictions on the Number of Dental Procedures or Treatments I Can Receive in a Year?

Are there any restrictions on the number of dental procedures or treatments you can receive in a year?

Some dental insurance plans have limitations on the number of procedures or treatments you can have in a year. These restrictions vary depending on your specific insurance plan.

It’s important to review your policy or contact your insurance provider to understand the limitations and ensure you maximize your dental insurance benefits.

Conclusion

So, there you have it! By understanding your dental insurance coverage, taking advantage of preventive care benefits, choosing in-network dentists, maximizing your annual maximum benefit, and utilizing flexible spending accounts, you can maximize your dental insurance benefits.

Don’t let your benefits go to waste use them to maintain your oral health and save money in the process. Your smile will thank you!

Welcome to my website! My name is Jett Kirkland, and I am a passionate and dedicated Dental Educator with a strong focus on periodontal treatments, oral infections and care, dental laser therapy, and holistic gum health. With years of experience in the dental field, I am committed to providing valuable information and resources to help individuals achieve optimal oral health.